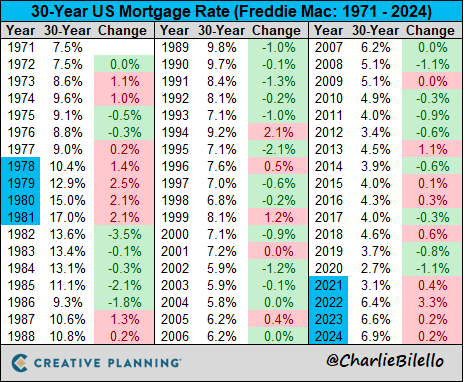

It ended 2024 at 6.9%. The last time mortgage rates rose for four consecutive years was in 1978 to 1981, when Paul Volcker was Chairman of the Federal Reserve and was engaged in an epic battle against inflation. Here is the table:

The big question is whether in 2025, Americans will experience an unprecedented fifth year of rising mortgage rates.

Inflation has not been defeated. The efforts of the Federal Reserve to tighten monetary policy got cancelled out by the Biden administration's loose fiscal policy (big spending not paid for by taxes, but with borrowing).

The only way to defeat inflation is to do it the way Milei is doing in Argentina. The Argentinian central bank had raised interest rates to a staggering 80%, but the previous Argentinian govt cancelled that out with big spending. It was only when Milei cut government spending, that Argentinian inflation started to come down.

Will the incoming Trump administration cut spending? Despite excitement about the new Department of Government Efficiency (DOGE), the markets fear that the savings will be tiny when set against gigantic welfare entitlements. And they believe Trump won't cut welfare, as many of his voters depend on it.

Then again, Trump may surprise everyone, as he's a one-term President, he doesn't have to worry about re-election. Though Republicans in Congress will be eyeing the midterms nervously.

If Trump cuts taxes, without cutting spending, the deficit will blow out and inflation and mortgage rates will continue to be high. That might lead to a painful credit crisis.