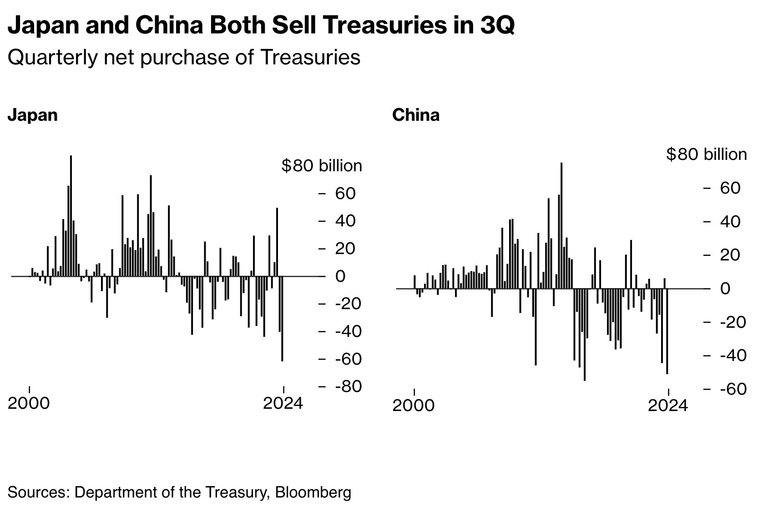

So now we know why US Treasury yields were soaring in the lead up to the US Presidential elections - two huge sovereign countries, Japan and China, were dumping some of their holdings.

Investors and pension funds in Japan sold $61.9 billion and China sold $51.3 billion.

This is down to "Trump risk" - the perception that his policies are inflationary, plus the likelihood he puts tariffs on these countries, destabalising them.

In addition, on 11th and 12th July, Japan was defending the Yen, they sold some of their Treasuries to get liquid dollars, and then sold $35.9 billion dollars to buy Yen and move it up.

The Trump administration is going to have to be careful lest foreigners sell more Treasuries, pushing US borrowing costs up.

If I was the Trump administration, I'd spend the first year getting the deficit down, and buy time by entering trade negotiations with trading partners, and only put tariffs on if the negotiations fail.

If you need to borrow from foreigners, it's not smart to antagonise the people you are borrowing from.

The Trump adminitration's situation is very different from say Eisenhower's. Eisenhower was running both budget and trade surpluses and the US economy was 50% of the world's economy, so of course when Eisenhower said jump, the world jumped. Trump's USA is only 25% of world GDP, it's running both budget and trade surpluses, debt is at an all time high of 135% of GDP, and it needs foreigners to lend it money. For all Trump's bluster, the US is weaker than it has been for a while.