Bitcoin dropped to sub 30k and stayed there for a while. A general downtrend in the crypto market for the whole 2022. The all time high at around 68k from back in November 2021, seems like a distant past now.

Let’s take a look how is this effecting the network. Data on the numbers of transactions, new wallets, hash rate and the overall activity.

We will be looking at:

- Total number of wallets

- Active wallets

- Hash rate

- Number of transactions

- Fees

The data presented here is mostly gathered from the blockchains charts.

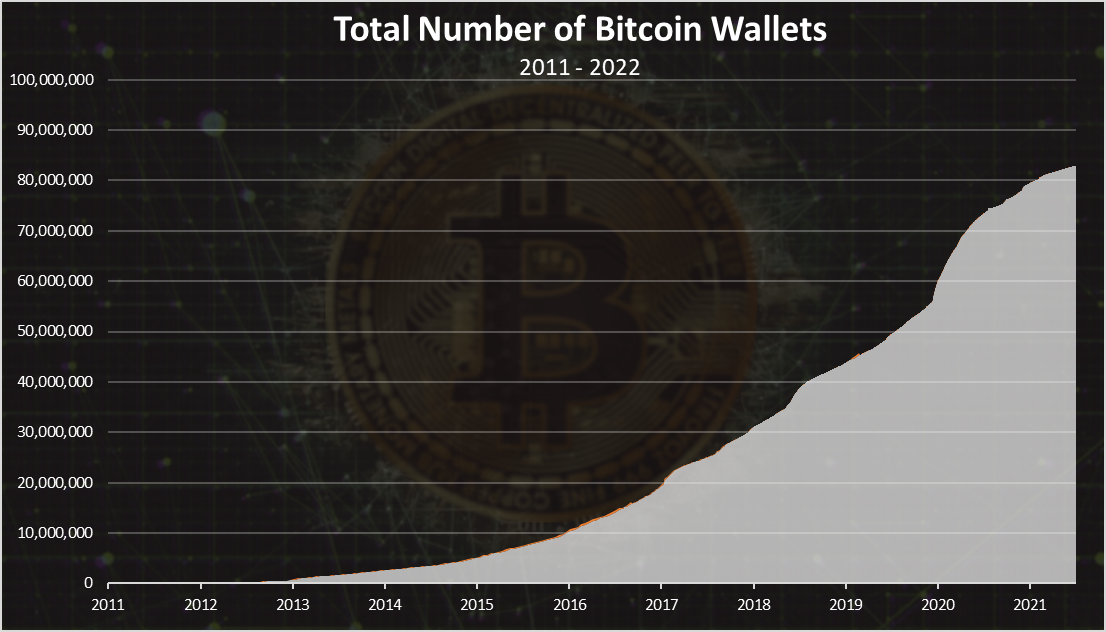

Number of Wallets

Here is the chart for the total number of Bitcoin wallets created.

Bitcoin has around 83M wallets now. We can notice an increase in the last year or two but let’s take a look at the last year for better clarity.

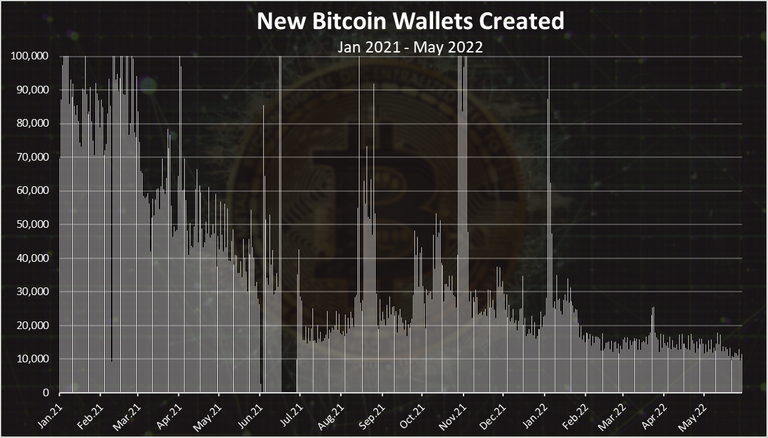

More new wallets were created at the begging of 2021, and we can see a slow decline since then. In the last period there is around 10k to 20k wallets created per day.

Overall, the number of new bitcoin wallets hasn’t followed the increase in price as much. One of the explanations for this would be that most of the newbies use custodial wallets, exchanges or some apps.

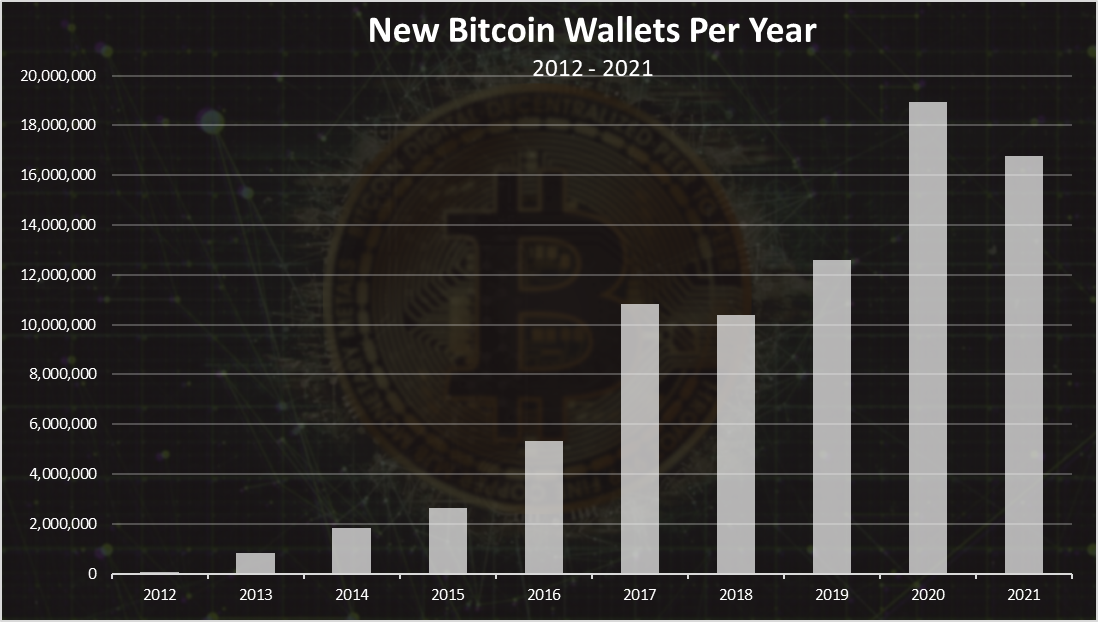

The yearly chart for new bitcoin wallets

The chart for the number of new Bitcoin wallets per year looks like this.

We can see that the ATH for new wallets is in 2020 with around 19M Bitcoin wallets created in that year. In 2021 there is almost 17M bitcoin wallets created, even though BTC has seen a massive run in price especially in the first half of 2021. This again is showing that most of the new users are most likely going on custodial wallets.

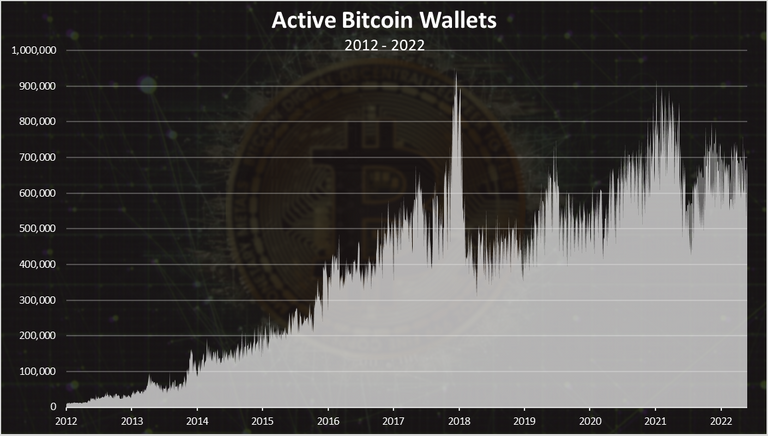

Active wallets

How many of the are being used?

Here is the chart.

The record high numbers for active Bitcoin wallets per day was reached in December 2017 with almost 1M active Bitcoin wallets. A sharp drop in 2018 to the 400k daily active wallets, and a steady growth since then.

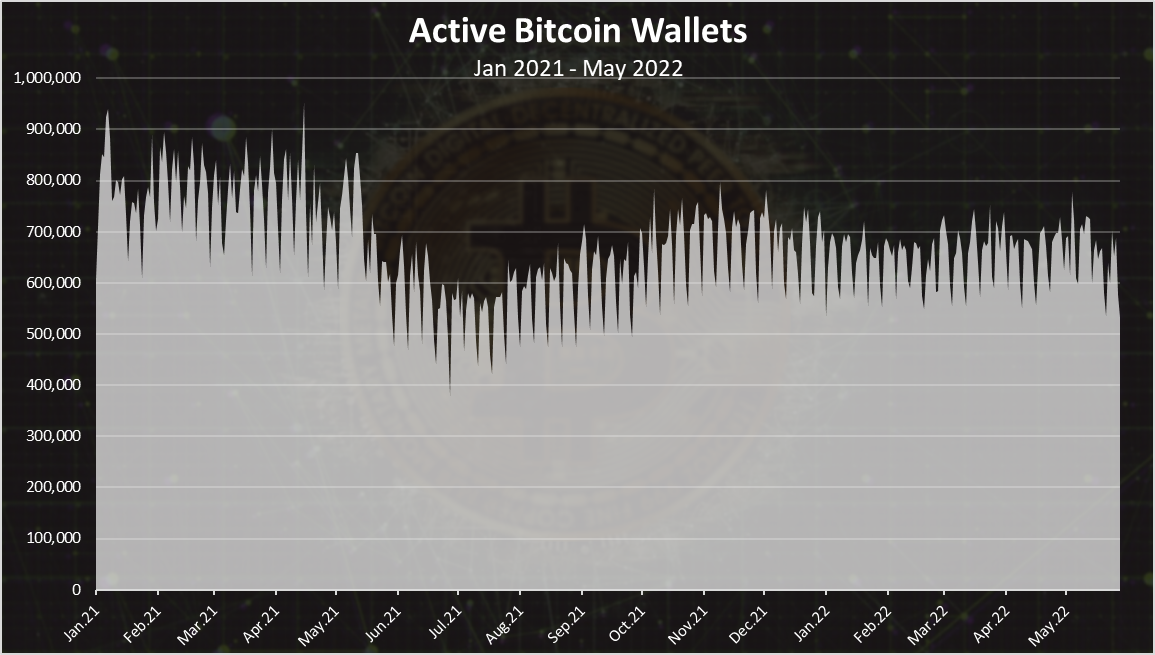

If we zoom in for the last two years we get this.

In the first half of 2021 there has been around 900k, but not a new ATH, then a drop and a slow increase again to around 700k where it is for a long period of time.

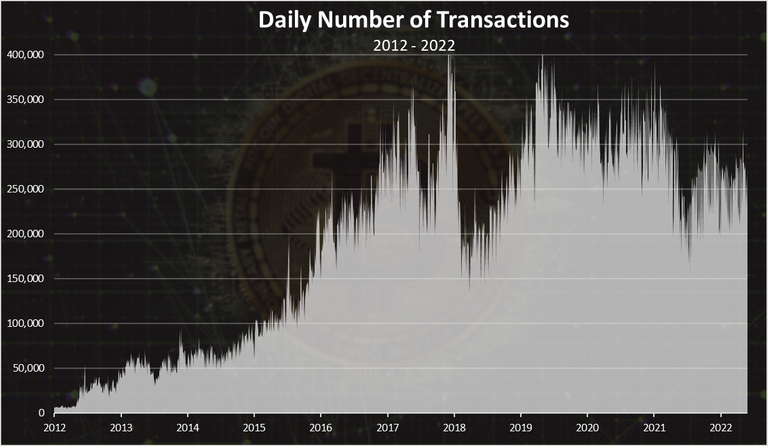

Transactions

The activity on the network is mostly represented by the number of daily transactions.

The transactions have been quite steady in the last years on the Bitcoin network with some down trend overall. This again indicates that more transactions are happening of chain.

We haven’t seen a new ATH for transactions per day. This number is around 400k. In the last period there is close to 300k transactions per day on the bitcoin network.

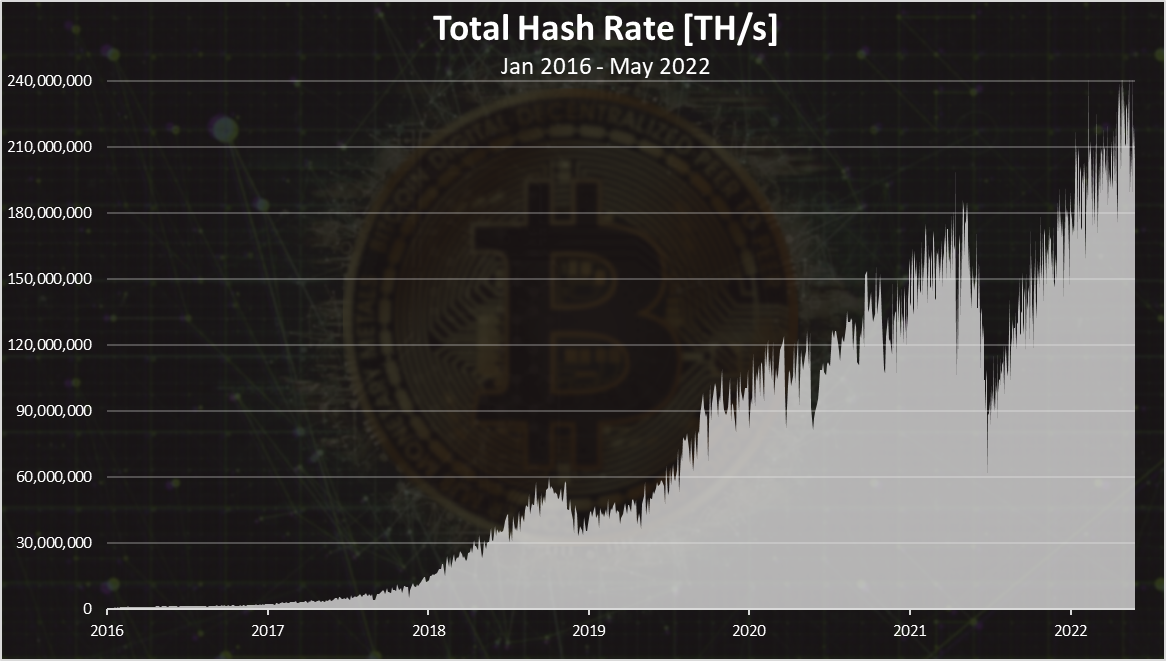

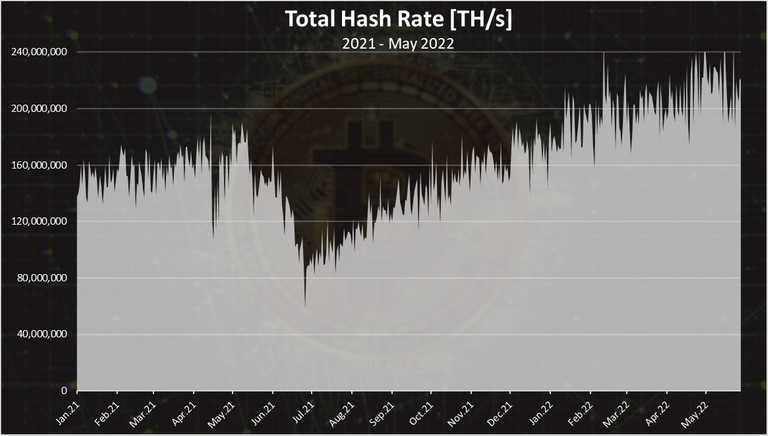

Hash Rate

The ultimate Bitcoin value is the network stability and security. The network security in a proof of work chains is measured in hash rate, or how difficult is to mine. The bigger the completion, the higher the hash rate.

The hash rate has been going mostly up, until June 2021, when we can see a sharp drop. This is because of the ban on Chinese miners. An increase again since then.

If we zoom in we get this.

At the end of June, the hash rate dropped below 100M TH/s, more than half from its previous ATH of 180M TH/s.

Since then, the hash rate has been recovering and has reached a new ATH in the last weeks of 240M TH/s. This shows the convictions of the Bitcoin miners for the network and basically most of them expect that the price will go up in the future.

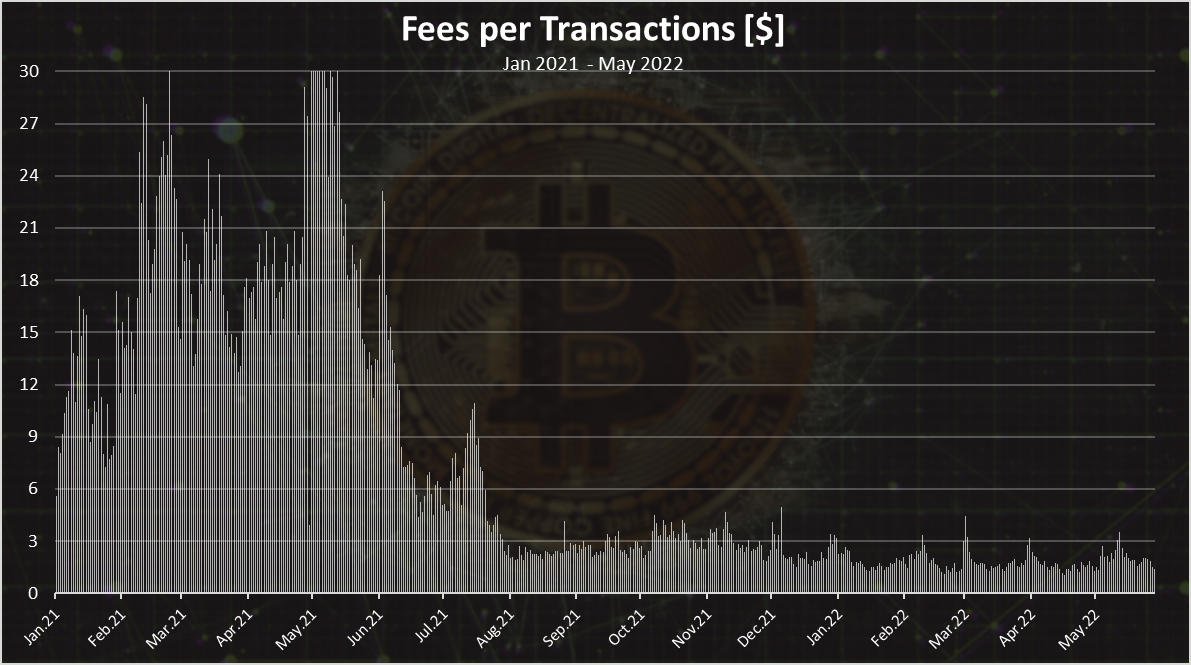

Fees

A bit unpopular topic the fees.

The bitcoin fees are quite low these days, with only a few dollars per transaction. At the beigng of 2021 the fees reached 30$ per transactions.

The bitcoin networks seem to have quite a steady numbers despite the drop in the price. The number of new wallets created, active wallets, transactions … all remain stable in the last months. The hash rate / mining power, keeps growing. Obviously, miners keep increasing their capacity and now the bitcoin network is more secure than ever.

Overall, it seems that there are long term players in the game now, that are not giving up when the price of Bitcoin drops.

The other metrics, like wallets and transactions are quite steady and are not showing much correlation with the price, indicating that new users are either custodial or its mostly institutions and big players entering bitcoin, while retail looks for some other coins.

All the best

@dalz

Posted Using LeoFinance Beta