Unlike most of the other algo stablecoins HBD is set to deppeg by design. It is the famous Haircut rule.

This is a major pro and con at the same time. It makes sure that HIVE and therefore HBD will never super inflate and go to zero, ergo the LUNA scenario. On the con side, it constrains the HBD supply, and it doesn’t make HBD a hard pegged stablecoin.

I guess it is logical for something to lose its value in an extremely bad economic environment other than pretending that everything is OK.

HBD, formerly SBD has a history. It has went through a bear market and survived. However, it has lost its peg to the dollar during the previous bear market.

Since we have a historical data on this, lets take a look at the past.

Note, up until March 2020, HBD was known as SBD, from its predecessor chain, and that data is included in this analysis.

What is the haircut rule?

The haircut rule comes in force when the Hive debt reaches the limit set by the blockchain, currently at 10%, and starts to devalue HBD for on chain conversions. When the debt limit is reached HBD cannot be converted to a dollar worth of HIVE.

The higher the debt the lower the price of HBD. For example, if the debt is at 11%, and the limit is 10%, the HBD price from the blockchain will be at 10/11 = 0.909. If the debt is at 20%, the HBD price from the blockchain will be 10/20 = 0.5.

While this mechanism makes possible for HBD to break the peg, it is also extremely important to prevent death spiral that we have seen with UST.

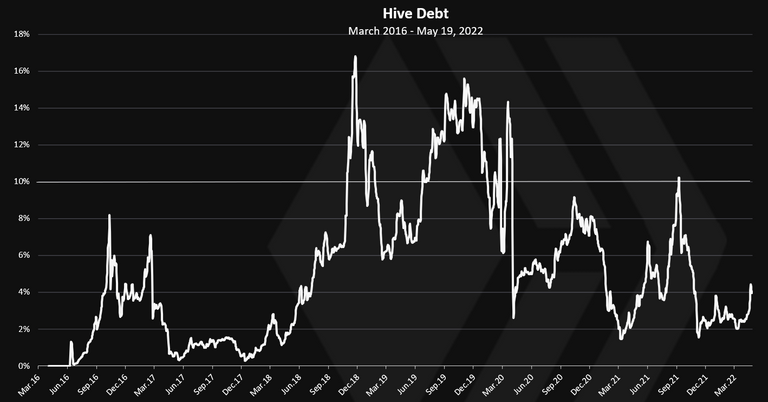

Hive Debt

I have went in details in the postHow is the Hive debt calculated. Because it is the main parameter that determines the HBD value it is important to know the details.

Here I will just mention the TL;DR.

The Hive debt is a calculated as a ratio between the HBD in circulation and the Hive market cap. DEBT = HBD in circulation / HIVE Market Cap. The HBD in circulation doesn’t take into account the HBD balance from the DHF/DAO account @hive.fund. Currently 24.8 – 16.3 = 8.5M.

The market cap for Hive is calculated from the virtual Hive supply and the price feed for HIVE. The virtual supply includes the total amount of HIVE plus the theoretical HIVE that can be converted from HBD at the current price feed. The price feed is a historical 3.5 median price for HIVE as reported from the top 20+1 witnesses.

A record high for the Hive debt has been 16%! This lasted for a very short period of time for a few days.

Another thing that happens when the debt limit is reached is that HBD stops being printed, and all the author rewards are paid in HIVE. The transition from HBD to HIVE payouts starts when the debt reaches 9% and between the ranged of 9% to 10% author rewards are paid in Hive Power, HBD and liquid HIVE. After reaching 10% debt only HIVE is paid.

In the next Harfork the debt limit will be raised to 30%, and the transition limit when HBD stops to be printed will be between 20% to 30%.

As we can see from the chart above, the debt limit for HBD was broken on two occasions in the past. Once at the end of 2018, between September and December, and once again from August 2019 up until April 2020. The second period lasted quite long, almost nine months, although on a few occasions in that period, HBD did restore its peg.

With this said now let’s take a look at HBD price.

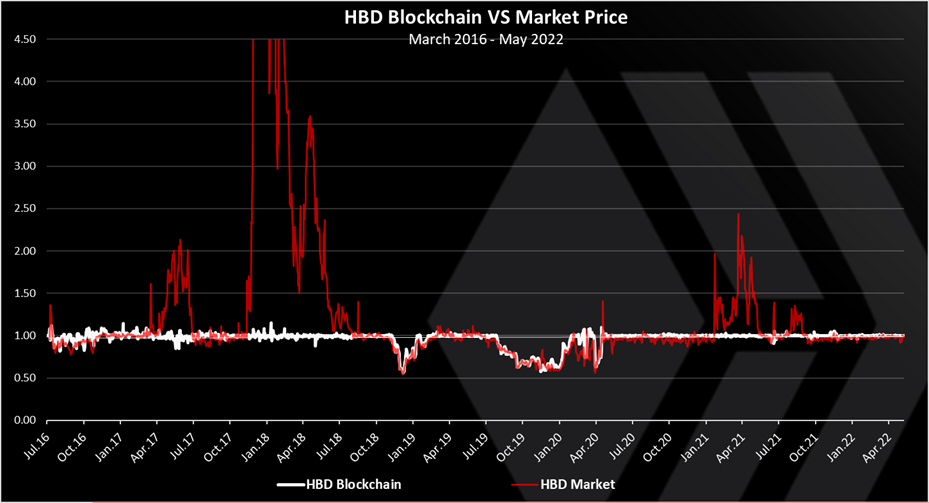

Blockchain VS Market Price

First lets make the difference between this two.

The blockchain price for HBD is at what price the blockchain is valuing HBD when HBD to HIVE conversions are made. When the debt level is under 10% the conversion always give a dollar worth of Hive for each HBD. But when the debt level is above 10%, the conversions stops giving a dollar worth of HIVE for each HBD and lower the price. At the record high levels for historical debt for 16%, HBD is valued by the blockchain at $0.62.

The market price is the price for which HBD is traded on the external exchanges like Upbit. HBD can be traded for whatever price the buyers and sellers agreed on the external markets, but the blockchain will always be giving arbitraging opportunities if the price deviates from what the blockchain price is. For example if HBD is trading at 0.8$ on Upbit, anyone can buy HBD there for a low price, then convert it on chain for a 1$ worth of HIVE and sell that HIVE for a profit. This will bring the price of HBD on the external market back to the dollar.

Sometimes because of the small market cap for HBD and the lack of liquidity, these arbitrages can take some time to execute.

As we can see from the chart above, the HBD price has been limited on the downside with the blockchain price quite nice. It has never broken the price that the blockchain provides on the downside.

But it has broken that on the upside. This is mostly because up to June 2021 there was no HIVE to HBD conversions. The conversions were only possible in one direction, HBD to HIVE. Whenever the HBD price was cheep on the external market, everyone can bought HBD, convert it to HIVE and make profit. But this was not possible when HBD would break on the up side because, HBD could not be created from HIVE at a price of a dollar.

From June 2021 the conversions from HIVE to HBD are possible and the price of HBD is limited on the upside as well.

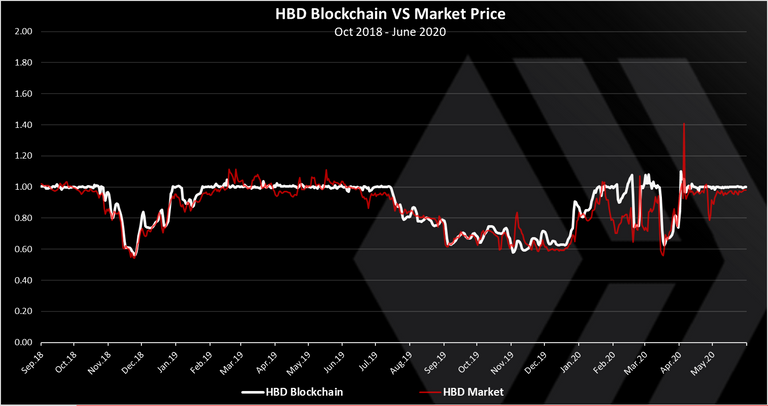

Now lets take a closer look at the period when HBD lost its peg.

We can see that the market price is closely following the blockchain price, with some exceptions in the spring of 2020, probably due to high market volatility.

The lowest that HBD went was $0.6!

In the first time December 2018 it lasted shortly only a few days, then it started to go back, first to 0.8, and in a month time it was back to $1.

The second time the deppeging lasted longer and it started more mildly, with HBD losing the peg in August and September 2019, slowly going down in a period of three months to $0.6 again. It stayed there from October 2019 to January 2020, with some fluctuations between 0.6 and 0.8. A four months period. There was another drop in April 2020, but this one lasted for a short period of time and was caused by the hostile takeover.

What does this tell us is that the conversions mechanics has worked well in the past. HBD was always defended on the downside with the conversions to HIVE.

Another very important thing to note is that HIVE now is very different then HIVE in 2018. Hell, even the name is different 😊. At the time there was almost zero use cases other then blogging on the chain. There was

- no Splinterlands, no gaming,

- -no second layer tokens like LEO,

- no NFTs,

- no 3Speak,

- no DHF at all, that now holds 16M

- no @hbdstabilizer with 150k daily HBD budget and growing

- and many more

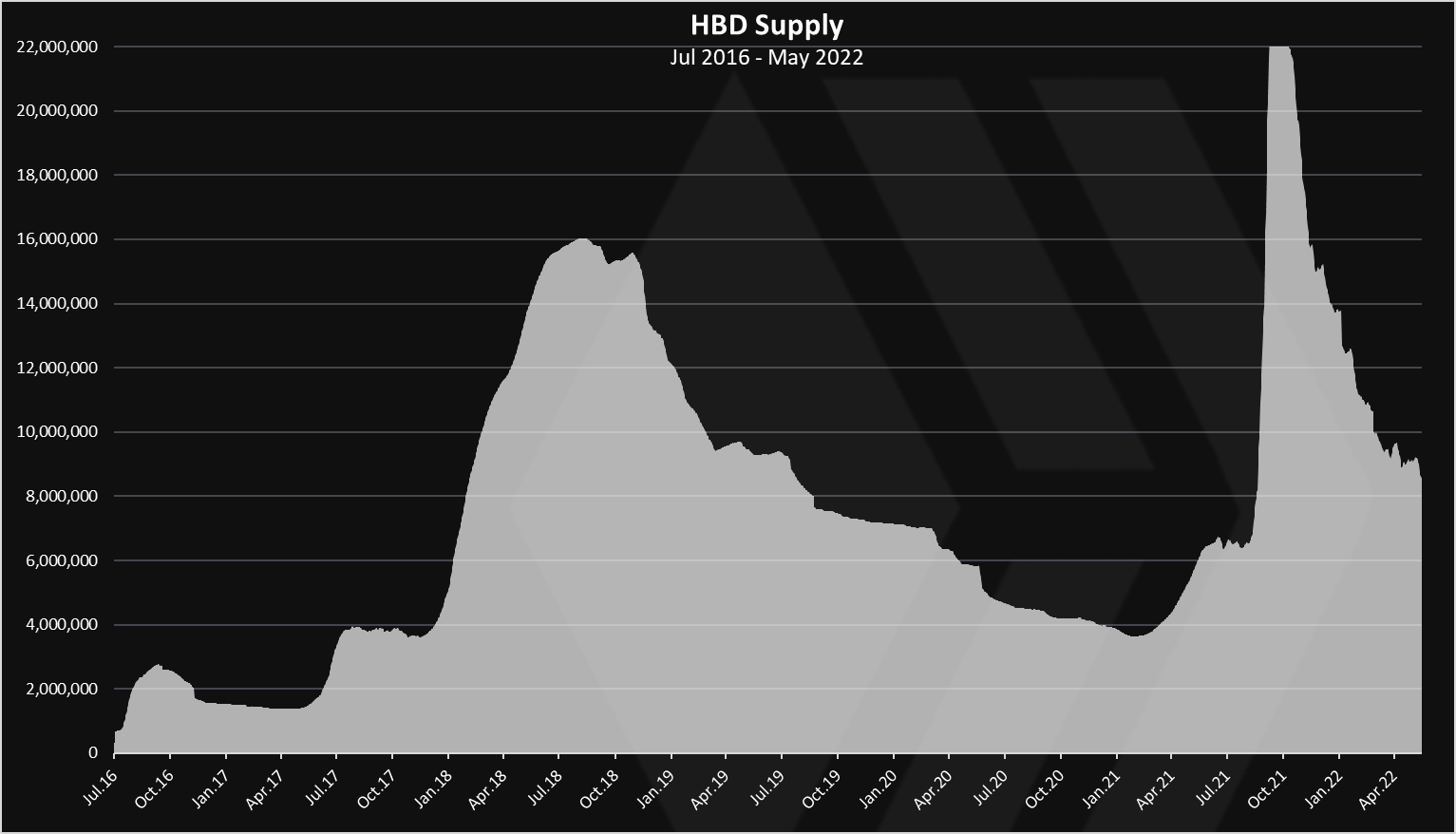

HBD Supply

The all time chart for the HBD/SBD supply.

Again, note that is the HBD supply excluding the DHF balance.

We can see that HBD had two major expansions in its supply. The first during 2018 after the bull market, when it reached a maximum of 16M HBD/SBD. Note that in 2018 the price of SBD was trading a lot more then the peg, mostly in the $2 to $3 region and sometime above. Meaning the market cap of SBD was higher.

The second one major expansion that happen for HBD was in September 2021, when there was an increase in the price of HBD on the external markets. This time the conversions from HIVE to HBD were possible and they took place on a massive scale, basically arbitraging the internal vs external markets for HBD. Because of this the HBD supply extended a lot in a short period of time, from 6M to 24M. Since then, the supply has been slowly declining and now we are around 8.5M HBD in circulation.

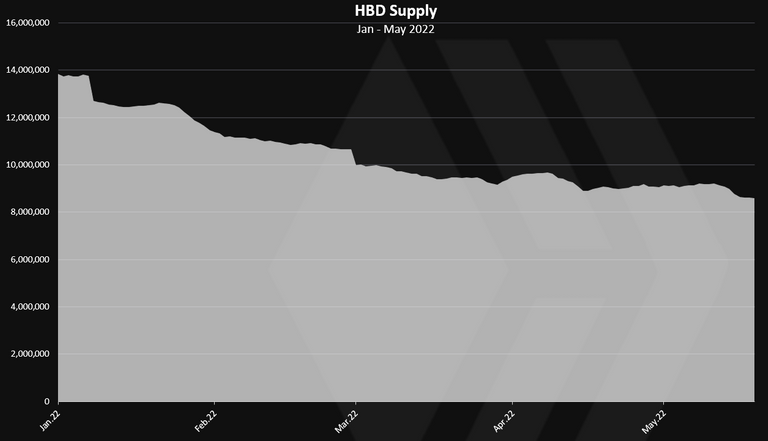

If we zoom in 2022 year we have this.

We can notice the downtrend here as well. At the beginning of 2022 there was almost 14M HBD in supply, while at the moment there is 8.5M. More then 5M in contraction for the HBD supply in 2022.

A very important thing for the conversions and the defense for the HBD is the supply. HBD supply is limited as a percentage of the HIVE market cap. This allows for HBD to be easily collateralized with HIVE, even with a high volatility of the underlying asset. It is a max ratio of 1 to 10. At the moment this ratio is 1 to 25.

The HBD supply is at 8.5M, while the HIVE market cap is more then 200M. Because of this small market cap for HBD, HIVE is having no bigger issues to maintain the peg for HBD.

Can HBD Maintain Its Peg In An Upcoming Bear Market?

The above has been an overview of the history of HBD. Now what about the future?

Well, nobody can tell for sure but let’s look at some facts and numbers.

What gives HBD its stability is the price of HIVE. It looks like the price of HIVE is performing a bit better than the last bear market in terms of following BTC. But this doesn’t mean it will continue do so. If we take a look at the HBD monitor tool https://hive.ausbit.dev/hbd, for the current supply of HBD, the peg can be maintained as long as the price of HIVE stays above $0.2.

This is for the current supply for HBD. But as we have seen the HBD supply kept going down in 2022 and has reduced from 14M to 8.5M. At the beginning of the year, for a HBD supply of 14M, the price for HIVE to maintain its peg was 0.35. As the supply for HBD is reduced so does the HIVE price needed to support HBD at $1.

Debt limit increase

10% is a very small debt level. It means that the collateral is at minimum of 1 to 10 ratio. These type of low debt levels are ok for a new projects that haven’t matured and are very experimental. But this blockchain and tech has been around for more then six years now and it has been tested in the period. Some things didn’t worked and were improved, and there is a room for more improvement. If the market cap of HIVE was in the top 50, I would say a 50% debt is perfectly fine. But since we are still in the middle sized projects with a market cap int the range of 0.2B to 0.4B and position somewhere between 150 to 200, a 30% debt is probably a more careful approach.

In the next Hardfork the debt limit will be increased to a range between 20% to 30%. Adding more debt is not risk free and it does increase the possible expansion in the HIVE supply from 10% to 30%. But this should give HBD holders more security in the HBD value and should probably increase the overall HBD supply.

For example, at the current market cap for HIVE and HBD, a 30% debt will allow a HBD supply of 70M HBD, while at the moment it is around 21M. A massive opportunity to grow without increasing the market cap of HIVE. The thing is HBD can come only from HIVE and more HBD created will push the price of HIVE.

On the down side, under the current conditions for the HIVE market cap and the HBD supply, a 30% debt level will allow the price of HIVE to drop to around 12 cents before HBD starts being devaluated, while this price now stands at 20 cents.

As we can see from the above the on chain mechanics for HBD has defended the price well on the down side with a sort of controlled deppeging for the stablecoin. In the past there was much less adoption on this chain a mechanics and code that we have now. The ecosystem is in better shape now then it was in 2018. Still a lot of things depends on the overall crypto market conditions and a significant drop in price is not excluded, that might cause a drop in the HBD price. If we can take one main takeaway from the above is that while the HBD peg has been lost in the past, it has always come back. It just might take a few months of patience.

All the best

@dalz

Posted Using LeoFinance Beta