For those who understand how Hive truly works, it is magical. People are being exposed to opportunities that few ever come across. We see the foundation being established where massive amounts of wealth are going generated.

The best part is everyone is free to join in.

Hive is a very simple system. Certainly there are a lot of moving parts and a great deal to learn. Anyone who is new can get overwhelmed very easily. However, the financial aspect to the ecosystem is rather basic.

Essentially, everything that is done on Hive is part of a process that can build more value. This means actions taken have an impact both personally and collectively. Since tokenization rewards activity, this forms the basis of all that follows.

In the end, Hive becomes a compounding machine. This means that anyone who couples rewards from activities with time will see growth. Put massive effort in over a long period of time and large numbers will result.

Source

Hive Power

The foundation of Hive is Hive Power (HP). This serves a few purposes:

- provides the ability to engage on-chain

- earns a 2.85% annual return to partially adjust for inflation

- can be used to curate content, generating curation rewards

- individuals can delegate other accounts, often for payouts in other tokens

As we can see there are a number of reasons to accumulate Hive Power. A number of years ago, the only way to accumulate was in HIVE and HBD. Today, there are more than 100 projects, most of which offer some type of token reward.

With so many other options available, many overlook the value that Hive Power offers. The price is volatile like most tokens yet does carry some upside. Since this also provides governance capabilities, it is beneficial to grow one's account. If, over the long term, one is optimistic about what is being developed here, having HP puts one in position to benefit from expected price appreciation. This means the speculative component can offer another layer of windfall in addition to the returns mentioned above.

Of course, as the HP in one's account goes up, so do the rest of the numbers. One can earn more in curation. The inflation adjustment also becomes a bigger (raw) number, in HIVE, as the account grows. Finally, there is more HP to delegate, if desired, to earn other tokens.

HBD Savings

The Hive Backed Dollars (HBD) is Hive's "stablecoin". It is a token that is meant to peg at $1 worth of HIVE. While it does float a bit, it is much less volatile as compared to most other tokens. This provides a degree of safety since, even if the price does stray, it is usually only temporary. Give it a bit of time and it moves back towards the peg.

Having a low-risk option is vital. Not everyone wants to be speculating all the time. There are time where even traders are looking for a risk-off move.

HBD is unique in that it is one of the few tokens that can offer a fixed return at the base layer. There are no third party applications to trust. One still owns his or her keys.

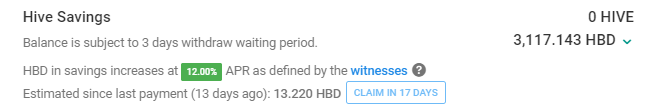

Placing HBD in savings is entering the fixed income market. Here is where a rate of return is set. With the HBD savings program, it is 12%. That is a very strong return for a low-risk holding with no counter party.

Each HBD that is placed into savings will earn .12 HBD. Of course, leave this and it compounds over time as the interest paid earns interest.

Source

Layer 2

We could write a series of posts about the second layer options. However, this is ultimately where Hive is going to excel. Most of the development occurs on the second layer since the design of Hive is to keep the base layer as streamlined as possible.

For those who are familiar with the ecosystem, here is where we see dividend tokens, tribes, games, NFTs, and an assortment of other options. Naturally, there is risk involved since not all projects will succeed. However, for those who can astutely navigate these waters, there are a lot of opportunities.

To start, one can enhance the rewards earned by focusing upon some of the tribes. Many have their own token and people can get those in addition to HP/HBD payouts. This can enhance the return.

Also, by staking the tribe tokens, much of the same process as HP applies. Once can earn curation rewards or delegate for other forms of payouts. Here we can see how there is more return generated, often through the same activity.

There are also a host of other tokens available that pay "dividends". This can be in the form of another token or more of that one. Some of these are INDEX, LBI, SPI, DHEDGE, and BRO. Having these in one's wallet means other tokens keep showing up on a daily or weekly basis.

Of course, the gaming arena opens up a different set of opportunities. This is led by Splinterlands, bringing NFTs to the forefront. Again, we could delve into this topic through a series of articles. The key point is that more options are available, often providing another level of compounding.

Source

Exponential Growth

Where will the Hive ecosystem be in 5 years in terms of value?

By this, we are not referring specifically to the price of HIVE. Instead, what will the entire value be of all these different projects. Not long ago, we looked at the idea of A Trillion Dollars On Hive. Whether that is ever reached or not depends upon, in great part, to how much we get compounding.

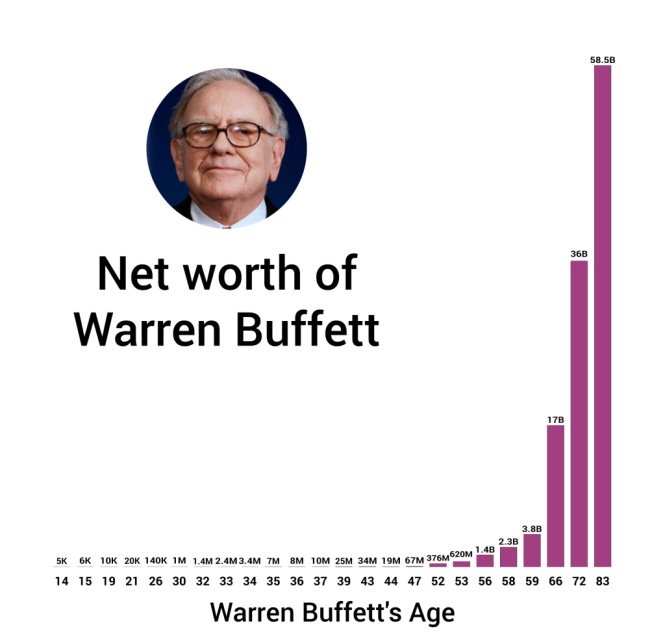

For example, Splinterlands has a few hundred million dollar in value with cards, land, and an assortment of tokens. Could that project compound at 25% each of the next 5 years? That seems very likely. If we presume a $200 million dollar figure now, at that rate, it would be over $600 million in 5 years. This is probably a rather conservative forecast based upon the way the game progressed over the last few years.

We often fall victim to looking at things solely in terms of USD (or some other fiat). This only provides one side of the equation. Since markets can be volatile, the number can be misleading.

One of the keys is to focus upon the number of units of a particular token. Here is a layer of compounding that often gets overlooked. As time passes, more tokens usually are distributed. The inflation is beneficial to encourage new users to participate. As projects grow, their token price ultimately will move up. However, markets can be fickle. Therefore, those who concentrate on growing their holdings regardless of market conditions will find their position is further enhanced when the bull does return.

All of this can lead to exponential growth. This is something most usually only experience when it comes to their credit card balances. Compounding at 18% or so a year means that $5,000 debt can get rather large over 5 or 7 years. Hive is giving people an opportunity to get on the other side of the equation. Compound your wealth instead of debt.

The ecosystem saw great evolution over the past few years. As the tentacles keep reaching further out, there are more opportunities for each of us. We are to the point where the choices exceed the resources that most have available. In fact, it can get a bit overwhelming. We can be like the kid in a candy store, wanting everything we see.

Of course, discretion is warranted. We have to select where we place our time and finances. Nevertheless, knowing that each can work to compound our holdings is vital.

There are numerous examples of people on Hive who experienced what is being described here. They showed up each day and took action. Each year, their accounts grow at a rate far exceeding the traditional system. The consistent action pays off as more resources are available for new projects. This can provide an additional windfall.

It is a very simply process to understand. Yet, judging from the actions of most, it is extremely difficult to implement. Most are looking for instant success.

Hive is a compounding machine. That means the numbers will be much bigger down the road. The crucial element is time. This can not be circumvented.

It is also the component most ignore. This is where the benefits are missed.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta