About a month ago, I figured out how to store native Rune on my Ledger Nano.. Since then, I have been using the ThorSwap app quite extensively.

Security

I did not want to store my Rune directly on my XDEFI wallet, or Trust wallet, as I don't feel my funds are safe enough. So, I went through the process of figuring out how to store RUNE safely on my Ledger Nano(which you can read by clicking the link above).

I was originally a little bit upset at the Ledger Nano for not allowing me to make an account the includes multiple chains to interact on ThorSwap like XDEFI or TrustWallet will allow you to do. On Ledger, each token has its own account which means making crazy trades on ThorSwap isn't possible.

The Beauty of THORChain

After Using ThorSwap for a while, I have come to find out that you don't need to ever trade your RUNE into another crypto. If you want exposure to BTC, ETH, Doge, BNB, BUSD, USDC (or any other project that you can find on ThorSwap) you can do so by entering an LP with 100% Rune. This means that I can do so from the safety of my Ledger Nano wallet!!!

(Cover, Thor #1, Marvel Comics 2007, Oliver Coipel)

Function and Security

By using the Ledger Nano on ThorSwap, you do sacrifice a bit of function for Security, but I believe this peace of mind is worth it. I cannot actually swap into other projects this way, but I can gain exposure to whichever project I want exposure to.

If I want exposure to BUSD, USDC and BTC. I can enter those three pools by simply throwing my RUNE into those three pools (effectively selling half of my RUNE for the other asset). When it comes time to withdraw, I, again, withdraw 100% RUNE (effectively buying back the RUNE with the other asset) and exit the Liquidity Pool. I collect RUNE by LP'ing in the process!

I don't get to hold the BTC, which doesn't bother me at all. It is a small sacrifice to pay for the security of holding all of my assets safely on my Ledger Nano. Holding RUNE doesn't bother me at all. In fact, I would like to hold more!

Bonus Points!

The clincher is gas. RUNE gas is currently really cheap. 0.02 Rune is the going rate (around 8 cents). I can pool with Native ETH or any asset on the Ethereum blockchain (or any other blockchain) on ThorSwap for 8 cents worth of gas. This is a game changer!

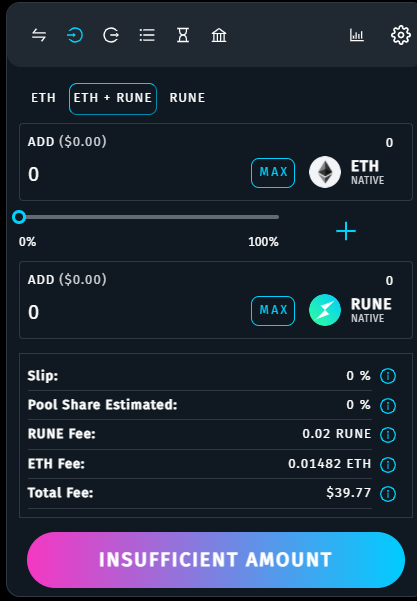

As you can see, at the top we are adding 50% ETH and 50% Rune to the pool. The gas is being charged on both ends. 8 cents in RUNE gas and $39.69 in ETH.

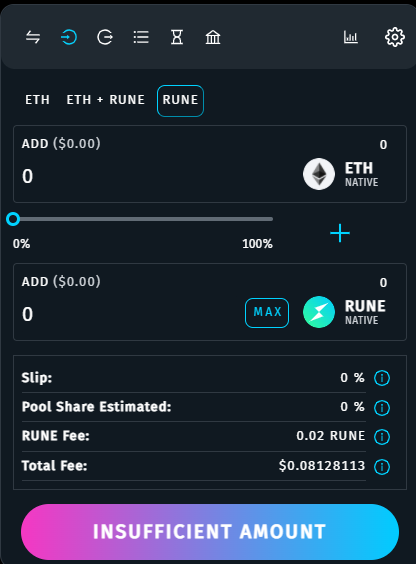

Check out what happens when I enter the pool with 100% Rune.

That is right!!! 8 cents. ThorChain effectively rids us of ETH gas fees for LP'ing with ETH assets.

Cost effective, safe and secure

Playing around on ThorSwap has really made me a believer in the THORChain project. Never have I been able to seamlessly and safely hold my crypto and gain exposure to whatever asset I want exposure too. Yes, you need to want to be holding RUNE all the time (which I find to be a really good idea).

Holding funds on ThorSwap is my new favourite savings account. I hold RUNE when I am bullish. I hedge my bets when I am bearish. Never do I leave the security of my Ledger Nano. Yes, I do limit myself somewhat with this strategy, but for now... Rune is where I want to be anyway.

I will write about how I plan to work my cross chain swaps when the time comes (it's easy and it costs 8 extra cents).

EDIT *** It is worth noting that on the Ledger Nano that the gas fee will appear to be 5.0 Rune. This is a bug on the Nano, gas will only cost what it tells you it will cost on your ThorSwap transaction... currently 0.02 Rune. I have done this and confirmed that gas costs are not 5.0 Rune.

Exchange images taken from ThorSwap.