As y'all may know that I am a very big fan and a firm believer of stacking physical gold and silver because that is real money without man made inflation that is used for more than 5000 years by humans.

Today's post will be dedicated to silver and it's price action. Hold tight it could become a long one but I promise I will make it worth your time.

Silver

Recently, Silver touched it's high of $26 and then has been falling since. It fell so much that currently it is trading at $22 per ounce. Let's look at the chart.

That green line is our current downtrend.

But it is not even the real manipulation. Let's zoom out the chart.

Can you even see the green line ?? That's my point. Silver hit it's all time high above $45 per ounce in 2011 and been falling heavily since.

Manipulation.

I am not a conspiracy theorist l. I only believe something when I see some source or facts behind it. I have enough reason to believe that the current silver price is highly manipulated. Let me list you the reasons.

1. Demand vs Supply

It is simple. Every market price should be determined by it's demand versus if it has the supply to meet that demand.

As for silver, it is not only used for collection and investment but also for industrial purposes. Silver's industrial demand has kept steadily increasing over the decades whereas it is becoming more and more difficult to keep up with the supply.

Look at this article for example which points out the production and mining issues world will face due to growing demand. It has an interesting chart from silverinstitute.org which gives us a clear picture that silver is the backbone of so many industries. They tried to replace it with others metals but failed. There is simply no exact substitute for silver ...!!

Let me post the chart here for those who are lazy. It is in the same article above.

If you are thinking that this article is old from 2016 and things have changed since then.

Look at this one from 2019 written by Dominic Frisby.

You can go through the whole article. It is a gold mine (Pun intended)

Let me quote you one paragraph from it so that I can move on my next point.

A geologist will tell you that ratio should be closer to 15: there is only 15 times as much silver in the earth's crust as there is gold. Indeed, 15 is the historical monetary ratio between the two.

He argues that since the natural physical ratio for silver to gold is 15:1. The price should be accordingly or atleast near it.

You'll be surprised to look at the current gold/silver ratio according to their price.

It is unreal.

2. Artificial supply

This one is the most neglected one when we talk silver price. The silver that we see now also takes into account the trading of paper silver which is silver etfs,bonds etc. These securities have a significant impact on price but they are just paper silver meaning no physical silver is traded here.

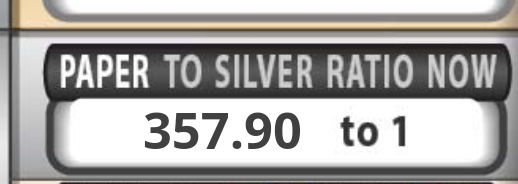

In fact, we don't even have physical silver to back the paper silver supply on the market. Confusing ? Look below.

This is the current paper to silver ratio which above 350+ which essentially means that for every physical silver ounce in existence there is atleast 350+ more ounces trading on the market. This is a clear case of artificial supply creation used by banks , financial institutions to keep the price suppressed.

Again, you may again accuse of being a conspiracy theorist. I mean why would banks do that right ? Why do they care so much about metal's price.

Number one : Free money

With the invention of these etfs they can sell 350x more for a single ounce of silver they hold which is free money for them that they can use in other investments for a way better return and pocket the profit. Evil huh ? Burn the bankers you say ? I'd be happy if they just leave the price to free markets that's all.

Number two : Trust in fiat.

Silver and Gold prices soaring while raging inflation in fiat will cause distrust in fiat and investors would together shift to metals for inflation hedge. So the money that investors put in mutual funds, etfs , stocks for wealth creation and safety against inflation would into metals. Trillions in losses. If I were a bank , I'd lose millions shorting silver instead trillions in investor withdrawal should there be an steady increase in metals for decades so the price affects all.

3. Naked shorts

Last but not the least, naked shorts.

These are clear, documented and effective technique or con should I say that banks do manipulate silver. They basically place a sell order in the market by millions without first buying. It is called as a naked short. While us common traders sell something to buy it back at a lower price but for banks the motive is to just have those gigantic sell orders there to artificially suppress the price.

But what happens if someone buys the silver order they created out of thin air ?? Congratulations you created an artificial supply of silver. Just increase that paper to silver ratio by 1 and enjoy. :)

There is one big bank named JPMorgan which has even been caught and charged in silver manipulation . The fine which they paid meaning they accepted it else they would have taken it court but they wanted to close the case by paying fines.

Watch this brilliant video by capital.com on the subject.

Conclusion.

The reasons given above aren't the only ones I think are the reason for silver price manipulation . There are numerous. May be a different post for it.

In an ideal world. These bankers should be behind jail for such a circus show but we are far away from there.

Let me know what do you think of my analysis.

Upvote and comment on this post to support my blog. It means a lot. Any suggestions or tips are welcomed as well.

Take care. Peace out.