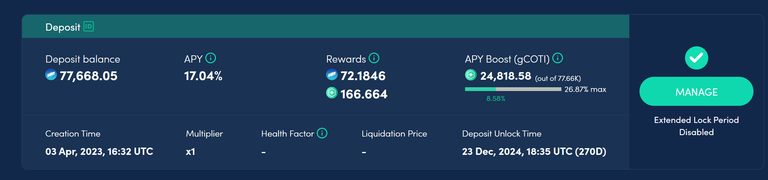

On Monday one of my staked COTI investments becomes unlocked and now decisions have to be made. The problem is not straight forward and there ae some calculations that need to be made to make the correct decision.

360 days staking does not fit in with regard to the timings due to were we are in this cycle and hat would mean there would be a penalty to pay for breaking the staking contract early. 270 days would take the staking to September next year and there is also a chance of breaking the staking contract. 180 days seems better but there is less APR on offer so I need to check the difference between the APR and taking into account any penalties.

360 days offers a 6.71% APR on Level 1 no risk.

270 days offers a 5.10% APR on Level 1 no risk.

180 days offers a 3.30% APR on level 1 no risk.

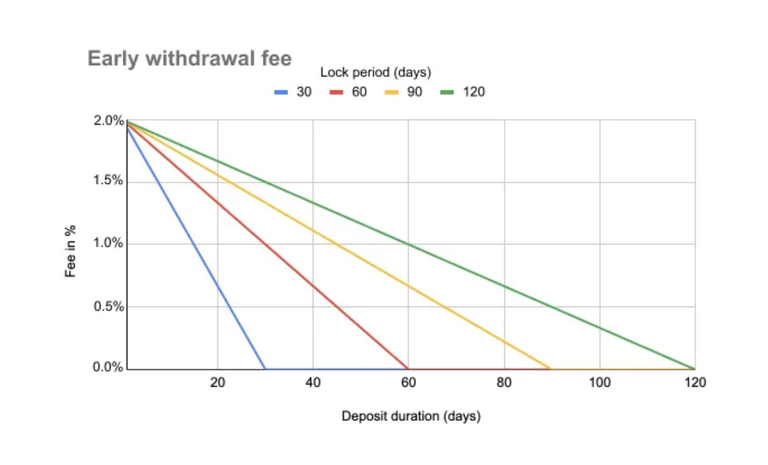

The maximum penalty you pay is 2% for an early withdrawal which does not sound like much, but in this case would be roughly 1550 COTI. At 13c that is around $200, but what if the price is $5 and why you are breaking the contract in order to sell as then the penalty is $7750.

The good news is the penalty of 2% is on a declining scale so the longer the stake remains staked the less you pay in a penalty when you break the staking contract. Therefore If the contract was broken in June Next year there would only be a 1% penalty.

The crazy part is if you went with the 180 day option you would loose out on 2.41% which as also factored in the penalty. You would benefit by 1870 COTI going this route and why it is always best to first double check what is the right action to take. Originally before doing these calculations I was swaying to the 180 staking period and I am glad I did this first.

Over the time period of roughly 6 months on the 6.71% APR excluding the bonus GCOTI which is an APR booster the returns would be in the region of 2570 with the roughly 1% penalty now being only 776. The rewards on the 180 day staking period would be 1264 so roughly earning 600 COTI less.

This is why you must never presume and do the calculations first making sure you have no regrets afterwards. I have messed up before which has cost me roughly 1000 COTI and why I make sure these days before pressing the stake button.

The other important factor I have not mentioned is that the longer you remain staked the more you earn in seniority when the air drops happen. The next airdrop happens in Q1 next year so this is probably worth an extra 10% and why the investment needs to remain in the Treasury for as long as possible.

Posted Using InLeo Alpha