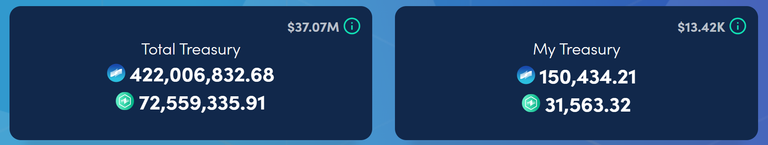

The COTI treasury TVL has 422 million COTI locked ad what amazes me is that number never really increases and may go up by a million, but then drops back down again. With the APR being earned the COTI Treasury should be growing at around 70K per day so every month this number should be rising by at least 2 million just through those that are staked and not new investors coming in.

Back on March 10th this year there was 515 million COTI locked within the Treasury which shows a drop of nearly 100 million COTI staked within less than 8 months. Yes some sold for profit, but they never reinvested what was sold. Some investors were liquidated which would make no real difference to the overall TVL as that COTI that was liquidated is dispersed as rewards to those that remain staked.

What this is telling me is that those with very big sized stake are selling their rewards each month instead of snowballing and compounding what they have making their stake bigger. I find that bizarre that investors could already be living off their rewards when the price is so low.

70K COTI being dispersed as rewards daily is only $7K or $210K monthly so what this tells me is that the really big accounts are not growing their stake. This is actually not bad news, but also shows a short sightedness amongst the early adopters who invested here.

If I divided my stake by the total COTI TVL locked up it shows there are the equivalent of 2800 equivalent sized accounts. I know some of these accounts are many millions in size so I would guess I am somewhere in the top 500 accounts by size. My aim is to obviously become much larger and one day have a passive income stream via the daily rewards being earned, but not until COTI has increased in price.

Selling and living off COTI whilst it is hovering around $0.10c kind of reminds me of the Bitcoin Pizza idiot as we all know COTI is only going to go up in value. I dare say these fools are the ones shilling COTI on social media whilst selling their rewards behind the scenes.

The upside of the COTI TVL never really increasing is the APR tends to stay fairly consistent and has not really dropped much over the last few months. Having a steady 6% without all the bonus APR from the governance token (GCOTI) actually makes it easier to grow long term and the bigger you grow the less the bigger accounts will earn in the future. This is why what they are doing is short sighted and makes no financial sense yet maybe they will regret their actions in the future.

Living off crypto is what many aspire to achieve in the future and I do think it is a solid plan if you have enough stake to make that happen. How many will sell too early and exit crypto altogether instead of using the stake to generate an income if you consider they are already selling their daily rewards? Just because you have a big stake does not make you smart as these actions prove they are not growing their bags even more.

Posted Using InLeo Alpha