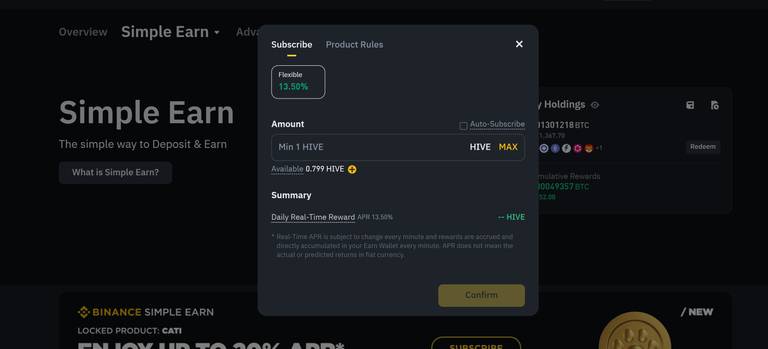

Well the 44.07% APR offered by Binance Flexible staking did not last long and after 5 days has dropped 30.57% ad is ow currently offering 13.5%. This is still very good and at least offers some extra returns whilst waiting to milk the pumps and dumps.

The only downside about this really is you have no sell orders in place and have to be awake when it all kicks off and could potentially miss out on a good 20% return in a few hours compared to earning a few tokens via the Flexible APR on offer and why I am hesitant about getting involved in this.

For now this is still more than what you would earn for staking and curation on HIVE except you have this as a liquid option. Curation earns around 10% and staking sitting around 2.75% so you are around the 13% APR level. I expect the Binance APR to drop even more as the volume levels rise and then the numbers earned will be minimal.

Thursdays for some reason have always been historically a HIVE pump day and who knows when the next pump will happen again. Does the Flexible APR rise then as IVE is removed onto the exchange and how may days does the APR take to drop as the HIVE is restaked. This is what interests myself and what I will be monitoring as we need to understand how to maximize our investment.

The upside to all of this is telling us investors are parking off their HIVE and are waiting for the right moment to sell making profit and to buy back again repeating this process. A little downer for those thinking this was another easy earner as the easy part never lasts in crypto.

I was looking in from the outside considering whether I would get involved in this or not and there is no urgency on my part as the numbers will continue to slide. This is still a good deal however as idle crypto not staked earns nothing and why we have to find a way to be earning 24 hours a day. Earning $1 a day is still better than $0 dollars so we do what we have to do in order to grow via accumulation.

Many on the outside not involved in crypto have no idea how much work and effort goes into building a portfolio along with the length of time this takes. We are talking many years and in my case this being the 7th year and I only consider what I have as a foundation and nowhere nearly done. Another cycle would definitely be required to make the difference especially when targeting income streams via crypto staking. This would then set the time frame at around 11 or 12 years which is a large chunk of time.

The good news is our head start from those who are not already in crypto would be significant. The saying the early bird gets the worm is very true and with us having some value already is money we do not need to invest. When we do see mass adoption any of those in crypto will have hundreds of thousands if not millions of dollars in value already.

Posted Using INLEO