The Solana chain has gone through a roller coaster ride. It has been one of the main stars of the bull run from 2021, reaching the top 5 in token valuation and an 80 billons market cap. Things have changed a lot and for the worse. Solana was heavily supported by FTX, and the collapse of the exchanges had a major impact on the ecosystem, dragging the price to a single digit, under $10.

But in the recent months, things have changed, and Solana has now emerged as the start of 2023, ending the year with a massive growth reaching valuation more than 100 USD.

Let’s see how the network activities are doing under the current market conditions.

Solana has some unique tech. It is a sort of hybrid between Proof of Stake (PoS) and a novel concept that they call Proof of History. There is a lot to say about the proof of history concept, but in short here we will just mention that it is a concept that checks all the transactions in the right order/sequence. The Solana blockchain works with slots for periods of time, in which the chosen validators confirm the transactions.

Solana has a reputation for being one of the fastest blockchains, with a theoretical possible 65k transactions per second. Solana also has a controversial reputation over its decentralization since it has been put under maintenance and stopped operating a few times in the past.

We will be looking at:

- Number of wallets

- Active addresses

- Daily transactions

- Fees

- Staking and voting Rewards

- Inflation and supply

- Market cap

The period that we are looking into is 2021 to 2023.

The data for the analysis are taken from Dune Analytics, where I have forked existing queries for Solana and adjusted the time frame.

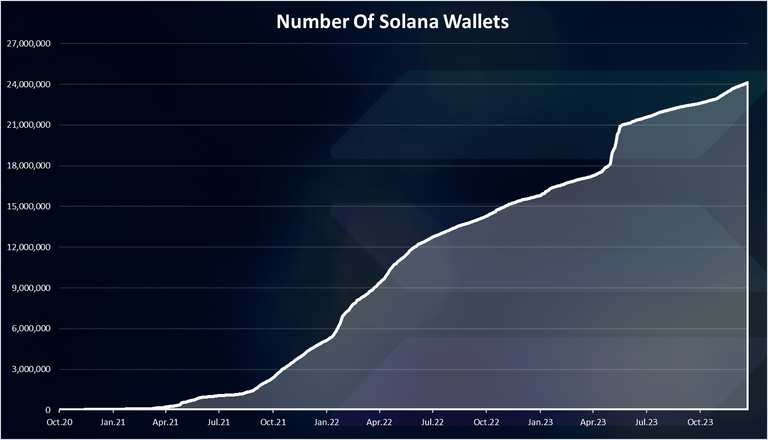

Number of Wallets

Here is the chart:

As we can see the number of wallets on Solana has kept on growing during the whole period. There is an uptick in April 2023. At the moment there are 24M wallets on the Solana chain.

Compared to the other chains like Ethereum, where the number of wallets is above 250M, the Solana chain still has room to grow.

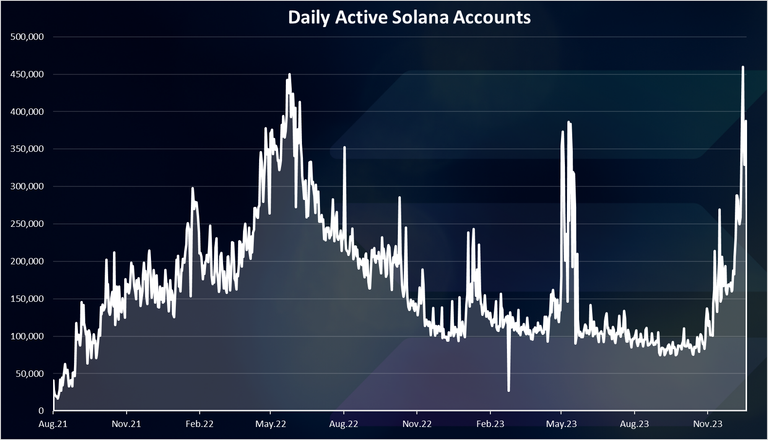

Active Addresses

One of the key metrics for a blockchain is the number of active wallets. Here is the chart.

A massive spike at the end of this chart with a new ATH for the number of daily active wallets. More than 500k DAUs on the Solana chain now. The previous peak was back in May 2022 when the ATH reached 450k wallets per day. Since then, there has been a downtrend for the Solana chain to 100k DAUs just a few months back in September. A massive increase since then and we are now at 500k.

For comparison the number of active wallets on ETH is also somewhere around 500k, even a bit lower these days, so Solana has come close to ETH even flipped it on some days.

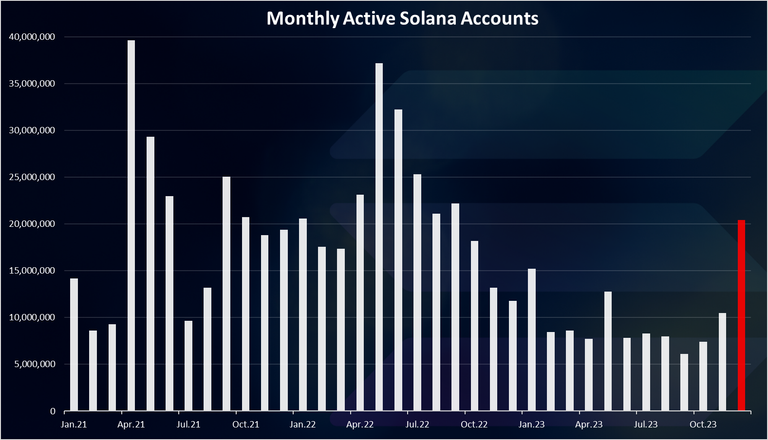

On a monthly basis the chart for active wallets looks like this:

On a monthly basis the previous ATH is still not reached. There were 40M active wallets back in April 2021. December will most likely end with somewhere around 20M MAUs.

Daily Transactions

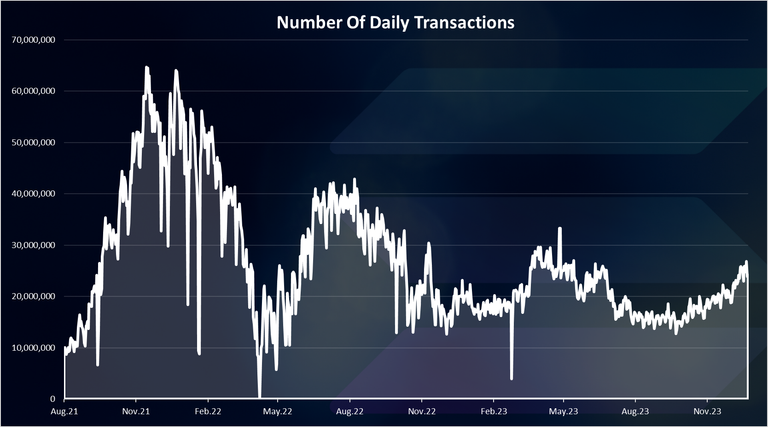

The activity on the networks is mostly represented by the number of daily transactions. Here is the chart.

The number of transactions is where Solana shines. It probably holds the record for a number of daily active transactions.

At the peak there were more than 60M transactions per day. In the last period there are between 20M to 40M transactions per day. In the last period the number of transactions has increased from 20M to 30M daily.

Compared to ETH where there is just above 1M, or even Polygon where there is 5M to 10M transactions per day, Solana is leading by a lot.

Fees

Fees are quite the unpopular topic and one of the main reasons for the new EVM chains, as users are trying to find a way to escape ETH high fees.

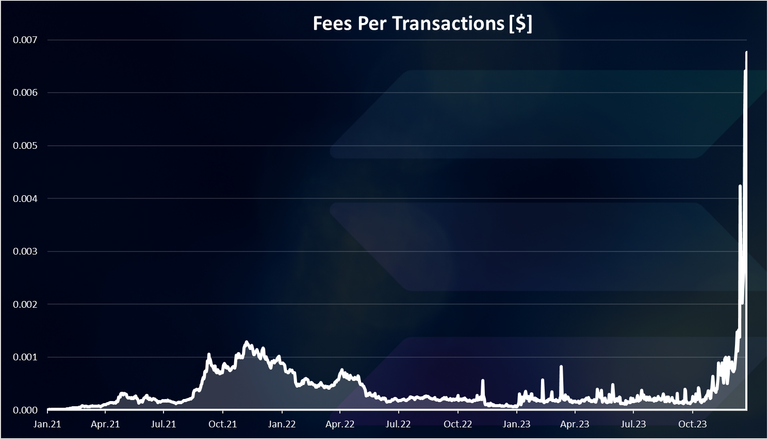

An average fee per transaction per day in USD.

A massive spike in the average fee in the last days, but the overall cost for transactions on Solana remains cheap under one cent or somewhere around 0.006 USD. In the past this was even lower.

Solana is one of the cheapest blockchain to transact on. Because of the very cheap fees we have seen a lot of botting on the chain, but it still manages the traffic. The thing is the validators need a lot of resources to maintain the speed and the numbers of transactions. Half of the fees are burned and half goes to validators.

Staking and Voting Rewards

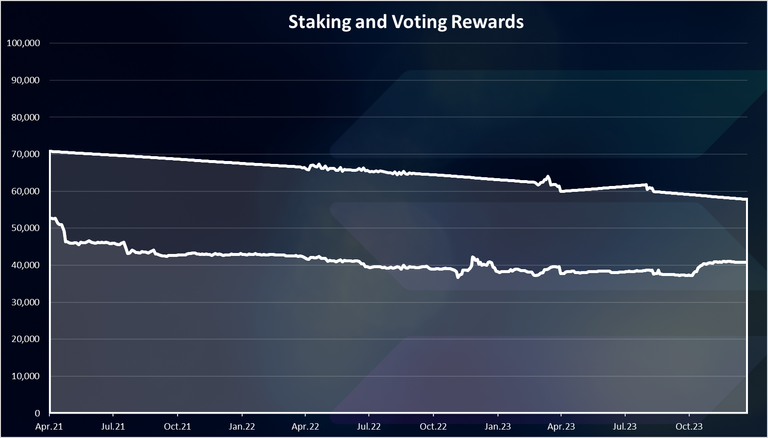

Fees are just one aspect that the Solana validator receives as rewards. There are also staking rewards and voting rewards.

Here are the charts.

The staking rewards are at the bottom of the chart, while the voting on the top. Cumulative these two types of rewards account for around 60k SOL daily.

The staking and voting rewards have been quite constant in the period, with a slow downtrend.

The daily SOL for staking rewards is around 40k, while the voting rewards are at 20k.

Inflation and Supply

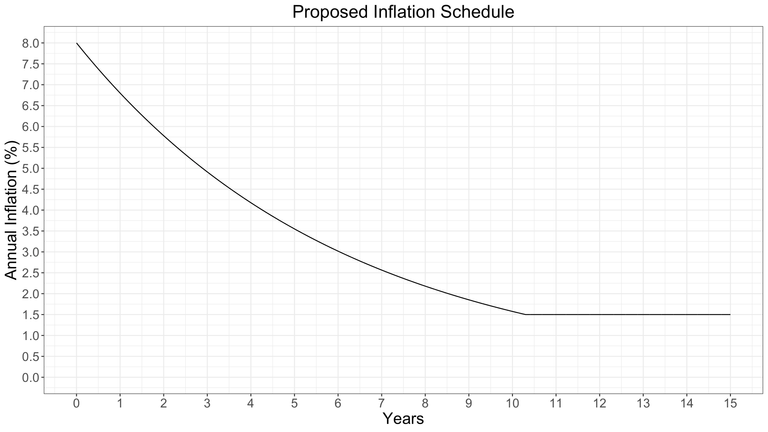

Inflation and supply are on of the most important metrics for a blockchain. Here are the charts from the official Solana docs.

The inflation rate for Solana starts at 8% per year and drops each year, reaching 1.5% after 10 years and stays at that level for the future years.

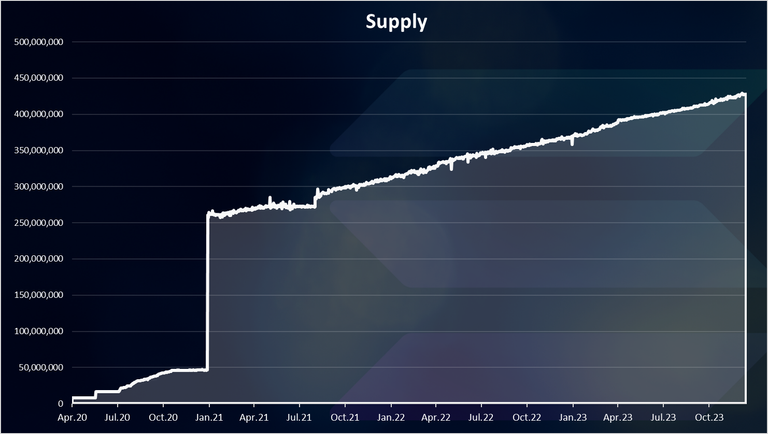

The supply looks like this.

The current supply of Solana is around 427M. From the inflation schedule it is projected to reach more than 700M in 10 years’ time. After that the inflation should slow down to 1.5% per year, and the supply should increase more slowly.

Market Cap

At the end the chart for the market cap.

At the peak Solana reached an amazing 80B market cap. At the moment the Solana market cap is around 40B almost 50% down from the ATH. Just a few months back, the market cap for Solana was around 10B.

All the best

@dalz