Memoir

/ˈmemˌwär/ noun. a record of events written by a person having intimate knowledge of them and based on personal observation. Usually memoirs. an account of one's personal life and experiences; autobiography. the published record of the proceedings of a group or organization, as of a learned society.

Double dueces. Next week's prompt made me revisit some memories I think I had mentally blocked. However, instead of being painful these memories made me even more grateful for my life today. Over the past twenty-two weeks Memoir Monday has proven its value to me time and time again but this week's prompt hit differently, more deeply. This one revealed truths that I don't think I could have learned any other way. Despite the struggles I'm going through in the present moment, I see my life in a different light now. It's not good to dwell too long in the past but it can it can teach you things if you revisit it from time-to-time. I hope you're reaping the same rewards as you're taking this journey with me and working on your own prompts.

Memoir Monday has grown so much that I won’t be able to comment on everyone’s posts anymore (and get my own work done) but I’ll still be supporting your posts with reblogs, votes, and shares on my other social media accounts (X, Facebook, etc.).

For all of those who’ve regularly participated in Memoir Monday - keep going, you’re making great progress in chronicling your very own life story for future generations to enjoy.

For those who missed the inaugural post explaining what the Memoir Monday initiative is all about you can find it here.

Now for next week’s Memoir Monday prompt:

How did you manage periods in your life when you had the least money?

My answer:

I was raised by parents who, wisely, didn’t use credit unless it was absolutely necessary for emergencies. This financial philosophy was passed down to me so I’ve tried hard to be responsible and live within my means for my entire life.

There have been a few time periods in my life where I struggled financially. The first was when I first moved from Ohio to Minnesota in 1995. I was twenty-four years old and relatively naive about how hard it would be to leave everything and everyone I knew and start over. I had been working for The Limited, Inc in Columbus since right after high school. It was a stable job with good benefit. This job allowed me to put myself through college but the opportunities for advancement just weren’t great and I didn’t make much money.

In the autumn of 1994 I met the woman who would end up being my first wife online. Our long distance relationship blossomed to the point I decided to move to Minnesota in July of 1995. I packed up my ‘91 Honda Civic with all of my belongings and had been sending resumes to companies in Minnesota to line up interviews but had no definite job prospects.

At the time I had six-thousand dollars to my name and it felt like a small fortune. My middle-aged self winces when I think about how badly this move could have gone. Youth, combined with wishful thinking, and a healthy smattering of naïveté can sometimes allow you to take huge leaps of faith. Thankfully, after lots of interviews I found a job in a couple of weeks at a very reputable insurance company in St. Paul called Minnesota Mutual (they later became Minnesota Life, then Securian) working in the mailroom.

I was thrilled to find a job but wasn’t making nearly as much as I did back in Ohio at The Limited. To make matters worse the cost of living in St. Paul was considerably higher than it was in Columbus. This is one factor I didn’t take into consideration when I moved. I burned through my savings in just a few months and was living paycheck-to-paycheck with only the safety net of a credit card.

Money was tight for the first three years but having grown up without much money I knew how to live frugally. I adjusted my lifestyle and just didn’t spend money I didn’t have. It was as simple as that. My girlfriend and I had to keep track of each dollar we spent. Entertainment consisted of hanging out with friends at home, walks, rides in the car, and the occasional matinee at the local theater. The stress of it did affect me more than I thought at the time because I went from 175 lbs to 145 lbs within the first year. I actually look gaunt in pictures from that time.

There were a couple of times during those really lean years my parents inadvertently saved me. As I recall, they did this twice. I was scrambling to try to come up with enough money to pay the bills and out of the blue they sent a hundred dollar bill enclosed in a short letter. I never asked them for money but they must have somehow known I needed it. I sure was grateful for it. I ended up getting several decent promotions at Minnesota Mutual, our financial situation gradually improved, and we started to be able to save money and invest.

The second round of lean years were during the Housing Crisis. My current wife and I bought a house at almost the height of the real estate boom in 2007 just before the market crash. Property prices were near their peak and mortgage lenders were taking huge risks, loaning people way more money than they could afford.

I knew that our budget was going to be very tight once we were in the house and had reservations about it. The loan officer was both persuasive and creative. He said that we could pull it off with an 80/20 mortgage (which is now illegal). The first mortgage financed 80% of the home price, and the second mortgage covered 20%. The problem was the smaller loan had a variable interest rate which inflated the monthly payment tremendously.

I was still relatively young, and hadn't yet reached the "glass ceiling" at Minnesota Mutual. I optimistically assumed my salary would catch up. Our plan was to refinance both loans into one traditional mortgage within a year but the Housing Crisis hit and banks were forced to tighten up lending requirements.

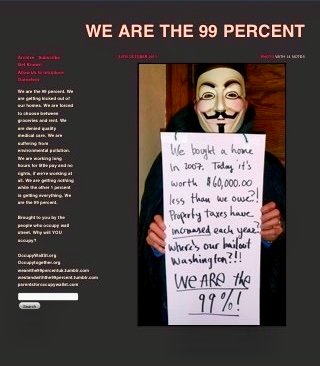

Once again our youthful optimism and bad timing put us in a precarious position. The housing market collapsed. In a matter of weeks our house was worth $60k less than what we paid for it. Under the new lending rules we no longer qualified to refinance. Our options were to either continue to be poor and pay the loans down or declare bankruptcy and mail the mortgage company back the house keys. Many people in our neighborhood chose the second option. During the worst of the crisis (2008-2010) about 25% of the houses on our street had been foreclosed and were vacant.

To add insult to injury the City of St. Paul increased property taxes exponentially over the next two years. Normally, property taxes are tied to the market value of the house but St. Paul decided to meet budget shortfalls by charging homeowners multiple, “special assessments” that had to be paid within 90 days. The largest of which was almost $7,000. This was a massive blow to families who were already struggling. Although we did nothing wrong we felt like we were being attacked by all sides and everyone was getting bailed out but us homeowners.

As luck would have it, in the fall of 2008 our adult son needed a place to stay. He moved in with us and the rent he paid us allowed us to skate by during those really lean years. We felt abandoned and bamboozled by the city/federal governments and lending institutions. Something great was born out of this tragedy though. The Housing and subsequent Banking Crisis was the catalyst for the creation of Bitcoin, which little did I know at the time, would dramatically change my life for the better less than a decade later.

Our first beagle, Bud, passed around this time as well. After a few months we decided to get another beagle. We drove a few hours west to Litchfield, MN to pick up Amstel (Yes, my wife names our dogs after beers).

Amstel really helped us to focus on something fun and positive during the challenging years. Thanks to him, our son, extended family, and our friends we still managed to make some great memories during those years. We were grateful for what we had instead of thinking about all the things we didn't have.

During both of these bouts of financial struggle I wasn’t always unhappy or frazzled. Somehow, our basic needs were always met. We still made great memories, some of our best actually. Having a tight budget wasn’t always easy but it did force us to be creative, focus on what really mattered, and use our wits. We rode out the storm on and we made due with what we had until our condition improved.

I discovered that when you’re in the midst of a crisis you’re way too busy concentrating your energy on surviving to notice what you’re missing out on. The stress of continually trying to make financial ends meet, even if we’re not conscious of it, does take a tremendous toll on you over time though. I lost a considerable amount of weight during the first crisis and the second crisis visibly aged me.

As the old saying goes, “What doesn’t kill you makes you stronger.” These two periods of financial struggle most certainly did do that. They also forced me to learn some valuable lessons that I won’t soon forget -- you can be happy with less than you think, struggles never last forever, and never be lulled into the false assumption that the financial institutions and government are on your side.

Rules of Engagement

- Please reblog this first post and share on other social platforms so we cast the widest net possible for this initiative;

- Pictures paint a thousand words. Include pictures in your posts if you have them;

- Answer each Memoir Monday prompt question in your own post. If possible, the prompt question will be published in the week prior so you'll have the entire week to answer and publish your own post;

- Have fun with it, don't worry about getting behind, or jumping into the project at any point after we've begun; and

- Lastly, be sure to include the tag #memoirmonday.

It's that simple.

At the end of the next twelve months we'll have created something immensely valuable together. It's so important to know our "whys" in life and there's no better way to do that than this.

Someday all that will be left of our existence are memories of us, our deeds, and words. It's up to you to leave as rich of a heritage as possible for future generations to learn from. So, go ahead, tell your stories. I can't wait to read them.

Be well and make the most of this day. I want to sincerely thank all of the participants thus far. I've really enjoyed reading your posts!

Growing weary of the ads and divisiveness on mainstream social media? If so, why not try Hive? Click on this link to sign-up and join our growing global community.

Let’s Keep In Touch