Now that the SPS airdrop dayz are over (sad face) we have a few new reward pool incentives which allow us to continue making a return in SPS....

The three that interest me here are the three on Hive-Engine as it's easy for me to use some of the swap.hive I've already got there to just re-pool if I so desire...

But is it worth my keeping my Swap.Hive in place and/ or exchanging it rather than just converting it all to regular Hive....?

Three Hive-Engine Splinterlands assets pooling options...

According to this recent rewards distribution update post from @Splinterlands, there will be three newly rewarded Hive-Engine liquidity pools paid out in SPS...

- SWAP.HIVE: SPS - 1.5 million voucher a month

- SPS:DEC - 750K SPS a month

- SWAP.HIVE: VOUCHER - 375K SPS a month.

The amounts dropped on each pool per month have to be taken into consideration with the amount of value provided as liquidity - there may be twice as much SPS dropped on the SWAP.HIVE:SPS pool compared to the SPS:DEC pool but if the liquidity value provided to the SPS:DEC pool is less than half of that provided to the former, then pooling to the later would still be more profitable!

So we need to know how much liquidity is provided to each pool to be able to gauge the relative returns and you can find out details of the three Hive-Engine SL pools on BEESWAP...

Here are the state for the SWAP.HIVE:VOUCHER pool for example...

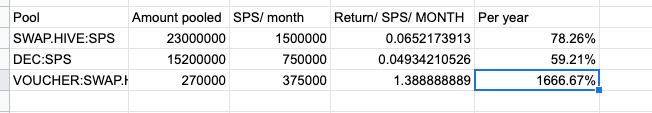

Returns on the three pools worked out in SPS for SPS terms...

I did a spreadsheet to make this really simple, and which was really simple - simply (lots of simples!) double the value in SPS (mathed up for the VOUCHER:SWAP.HIVE pool)... and you get the current returns....

As you can see despite having the lowest rewards there are better returns on the VOUCHER pool above because of the relatively low value of liquidity provided.

Maybe this suggests that VOUCHER is a little undervalued ATM?

They've for the incentives about right IMO for the first two pools - creating a higher level of incentive for SWAP.HIVE:SPS compared to DEC:SPS - the later two are the most closely linked in value and so maybe don't need to be incentivised as much!

Overall I'd say that ATW of writing all THREE of these pools are worth providing some liquidity too, especially the SWAP.HIVE:VOUCHER pool!

Final thoughts...

These are decent returns on offer currently (late July 2022), and things might well change soon given the very recent end to the main year long epic SPS drop.

One would expect, in fact, things to change as people get around to better managing their assets post said drop.

However it's good to see that ALL the pools have a decent return ATM of course!