I pay my gas and electric by direct debit, ATM that's £80 a month.

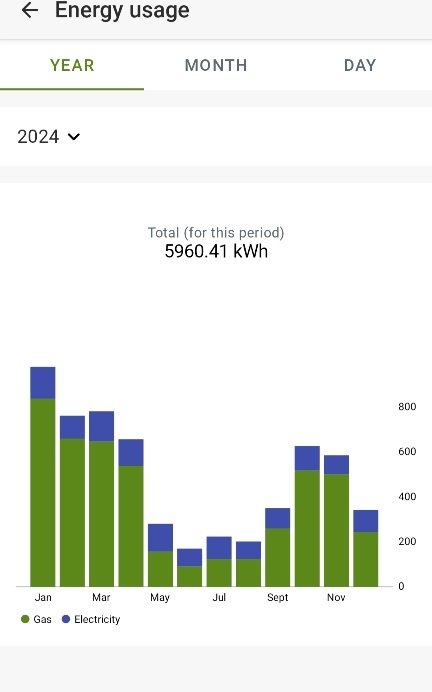

Obviously my energy usage fluctuates from month to month: I use less than half in the summer months compared to the winter months...

Looking at my monthly variation, I guess it's no surprise.... High in January to March, a little lower in April, very low in May - September, then rising Oct-December.

NB that's mainlyb the gas (in green) fluctuating, most of the electricity is the fridge freezer, electric shower, kettle and oven, which don't vary that much from month the month. Keeping the low energy light bulb (s) on for 16 hours rather than 8 makes very little difference!

Buffer build up

I've currently got a £200 buffer in my account, which built up over summer and is currently being eaten into - I'm guestimating it'll be around 000 by May when £80 should cover that month, and the it'll start building up again....

I'd be better of running a slight deficit for most of the year...

I don't think there's a penalty for doing this with most energy companies...?

But I got to thinking recently that if I have an average buffer of around £200 a year for the year, which is about right, then £200 times 5% = £10 I'm losing out on, in interesting on a high interest account....

And what do I get from that £10 sitting in my Scottish Power account... some fake peace of mind that I've got a buffer, it doesn't make any sense....

I mean OK it's only £10, but £10 is £10 and it's worth getting over this 'utility bill buffer mentality' to save myself a little bit of cash!

Posted Using INLEO