An unfortunate combination of economic conditions over the last few years in the UK have seen a rapid increase in the number of peoplem applying for mortgages with 35 year terms...

According to EuroNews 23% of first-time buyers now take out these longer term mortgages.... this is up from 17% in December 2021.

The two main drivers of this are increasing house prices and higher interest rates, the combination of which means the cost of buying a house is astronomical and now literally a life-long process, or at leat a working-life long progress.

But longer in some cases as more people are taking their mortgages into retirement, given that the average age of a first time buyer is now 32. I mean people still need time to live a little and save for a deposit, maybe less of the former these days if you want to become a home owner.

Or 'owner' as you don't really own your own home with a mortgage!

You can see why people do it, if you take out a £200K mortgage at 5% interest then your repayments will be £1170 over 25 years but only just over £1000 over 35 years, and when times are tight, like they are, that extra £150 a month can make al the difference.

The problem with the two models, is that adding on 10 years to the term costs you £70K more overall!

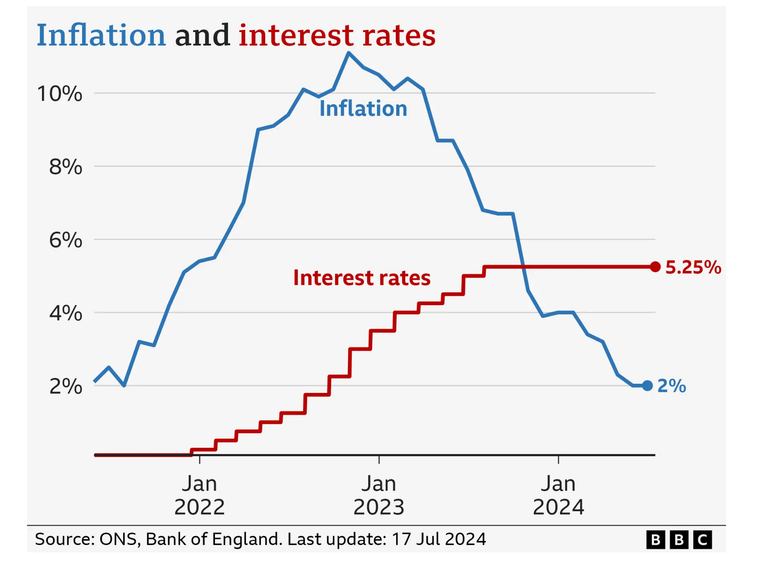

Inflation the root cause it seems..

High inflation is behind the relatively recent increase in longer term mortgages, or at least the standard response to high inflation which is to increase interest rates...

And although inflation is now back to sensible levels, interest rates don't seem to be following, and they won't be following for a few years in the cases of some people with new mortgages, many will be stuck at 5% for 5 years with fixed rate deals even if interest rates come down to 2-3%.

(I personally fixed at just over 5% a year ago, but with a small mortgage this matters little!)

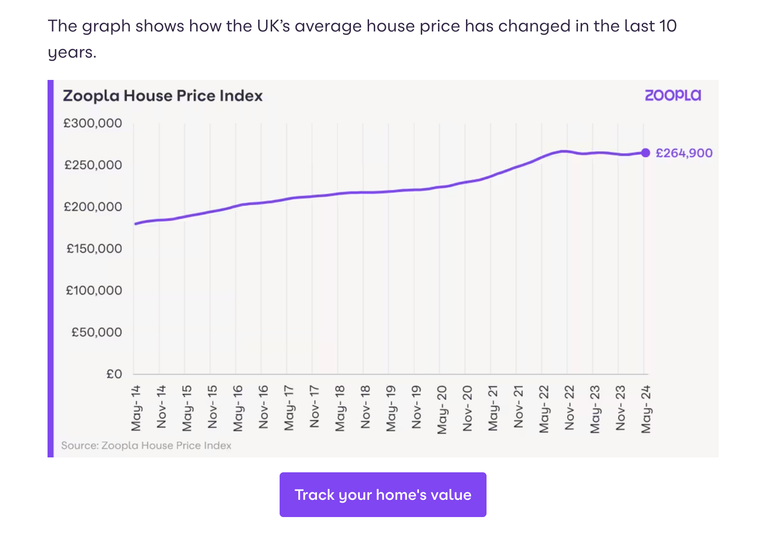

Stubbornly high house prices

What I don't really get is why house prices are remaining so high....? I guess it's just lack of supply, everyone needs somewhere to live, after all, and we all know both population and demand for more space per person per house is increasing too!

Final thoughts

It's not a great place to be in, being a potential house buyer ATM. Hopefully Labour can do something about this by getting more houses built, and keeping inflation under control.

It's not much of a life when your most basic need, housing, cripples you financially!

Posted Using InLeo Alpha