The recent events surrounding UST and LUNA are getting everyone's attention. This is making waves while having some fear that the entire industry is at risk. To me, this is just a test in resiliency. Quite frankly, if cryptocurrency cannot handle this, it deserves to go away.

Since HBD, like UST, is an algorithmic backed stablecoin, people want to draw parallels between the two. This usually ends with people concluding the same thing could happen to HBD. While we can never say definitively what will happen, we can analyze the different features in place.

In this article we will highlight some of the characteristics that set the two apart.

Simply put, what is hindering Hive's growth, along with HBD, is also defending both coins.

Shutting Down The Chain

One of the biggest problems with Terra is very little was on there. With Hive, we have a host of projects and applications. Development teams spent countless hours along with money creating their projects. They are not so inclined to have them shut down.

The Luna Foundation shut down the blockchain yesterday. This shows the danger in centralization. Anyone who built on that blockchain would have been out of luck.

With Hive, that is not possible. While the consensus witnesses could agree, there are others who are running the software. As long as they do that, Hive keeps going. One of the reasons to conclude this is many who are running nodes are also behind projects. To shut the blockchain down means turning off, to some degree, their project.

Go through the Witness list and see if you can associate the on-chain projects teams with the node operators.

HIVE-HBD Conversion Mechanism

One of the key features is the conversion mechanism whereby the stablecoin can be created utilizing the base token. On Terra, UST was generated by converting LUNA. The same is true on Hive with HBD being created from it.

However, that is where things end. With Terra, there were no precautions in place. On Hive, we see a number of them.

Before getting to that, we have to start with the core token. To be frank, HIVE is a pain in the rear to acquire. We all know that. So the starting point of acquiring a ton of HIVE is difficult.

LUNA was much easier to acquire, for reasons that were unnoticed until recently. This is where it all begins. Thus, if the core token is held in massive amounts, one can begin the attack.

Pre-Mine

This is something harped upon by many on Hive. However, it is one of the most valid points out there.

While there is no certainty with UST, it does look like the attack was carried out by getting a hold of massive amounts of LUNA from a pre-mine or Founder's stake. This handed someone the LUNA in some type of OTC deal. The key to this is that it does not drive the price up.

Hive no longer has a pre-mine that can be used against it. In fact, it is in the Decentralized Hive Fund protecting the blockchain.

Conversion From HIVE-HBD

The process starts by acquiring a lot of the stablecoin via the conversion mechanism. With Terra, this was done without penalty. On Hive, there is a 5% fee on each conversion.

This means that anyone staging an attack is going to take a 5% hit right off the bat. While this still might be worthwhile if the numbers are large enough, we can see how this is a bit of a deterrent.

So even if someone acquires the HIVE, something they will have to buy on the open market, driving up the price, they take an immediate hit when converting it to HBD.

3.5 Day Conversion Time

If our nefarious one still wants to carry on, opting for the 5% fee, there is another roadblock. The conversion time is only a few seconds, putting the HBD in the attacker's wallet. There is a catch though, it is only 50% of the total. The other 50% has a delay of 3.5 days before it is issued.

Here is another defense mechanism that is a hindrance to growth. We know the 5% conversion fees turns people away. Equally as damaging, from an expansion perspective, is the 3.5 wait time. There are too many variables for traders to deal with over that time. It is rather unappealing.

We know this by the lack of liquidity with HBD. However, from a security standpoint, this is a major difference maker between the Terra system. If the person wants to get the full amount of HBD, that is a 3.5 day wait time, with 50% being exposed to market conditions. Since the price paid is the average over that time, one's payout will likely change.

HBD Stabilizer

On the internal exchange we have the HBD Stabilizer operating. This goes in and buys HBD or HIVE depending upon the price. It does so using funds allocated from the DHF, proceeds that are returned.

Looking at the transaction activity in the wallet, we can see it receives 6,573 HBD every hour. Throughout the day it is filling orders, providing liquidity in an effort to hold the peg.

During this entire market crash, the internal market, for the most part, maintained the peg. That means, at any time, people could trade HBD for HIVE and get near $1. This differed from the price feeds picked up based upon activity on external exchanges. As we see, the amount of HBD available along with volume is minimal, creating a misrepresentation of the price movements overall.

HBD Liquidity

In addition to getting a hold of HIVE, it is even more difficult to get HBD on the open market. The HBD Stabilizer is potentially putting out roughly 150K HBD per day. This typically carries a 1% premium off the best price. Here we see another deterrent, albeit not an onerous one.

Going through the linked post above, we see that only Upbit and Bittrex offer HBD. The first is unavailable to those outside South Korea. As for Bittrex, it has no volume. So neither of this is really an option for most.

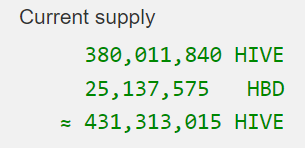

There is a reason why liquidity on these exchanges is tight. Let us look at the HBD float taken from Hiveblocks:

There are 25 million HBD in total. However, we see that the DHF has more than 16 million locked up. This means the total amount available is 9 million.

We also have 2.2 million on Upbit, which is an exclusionary exchange.

There is also another roughly 3 million locked in Savings and not immediately available. So now we are down to about 3.8 million HBD out there.

As we can see, getting a hold of HBD is even more difficult than HIVE.

pHBD

The pHBD-USDC liquidity pool on Polycub was set up to help alleviate this issue. The question, is that becoming a point of vulnerability? Could someone use that as an attack vector?

We are seeing the pool growing. In this instance, it is possible for someone to go in and buy up all the pHBD. At the moment, that is just shy of 200K HBD. Now we are talking about a decent sized honeypot for what is out there.

There is only one problem. The pHBD account maintains enough liquidity to conduct its daily transactions. With the excess, it is put into Savings.

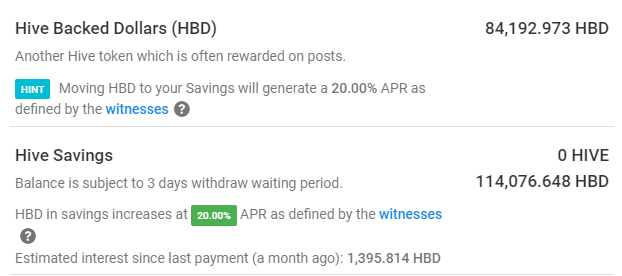

Here is what the account looks like:

Thus, our attacker could spent $198K purchasing all the pHBD. However, when going to bridge, only 84K would immediately end up as HBD. The rest would have to wait until the team moved the rest of HBD from Savings. Here is another 3 day wait in the process.

Of course, if there was a known attack, the team might opt to hold off on doing that, sensing that something is amiss.

Haircut

This might be the most powerful of defenses there is. It is also logical.

With a stablecoin of this sort, the redemption is a certain amount of the native coin for each stablecoin. At present, HBD can be converted to $1 worth of HIVE.

Here is where the situation on Terra completely fell apart. Logic would say that for this to be a valid system, there needs to be a spread in the market cap of the native token and that of the stablecoin. If not, there no way to back it up.

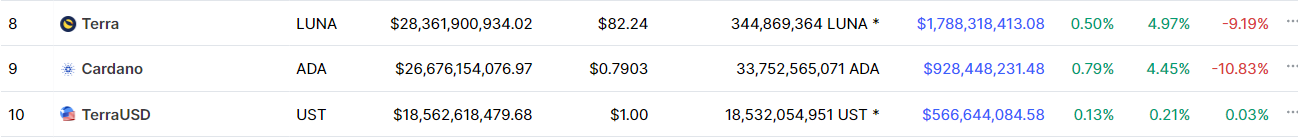

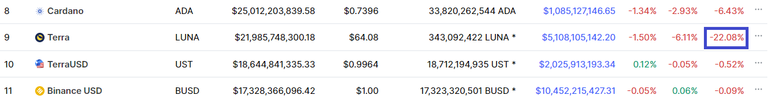

With UST, the market caps were fairly close. Here we can see from the historical data on Coinmarketcap.com what things looked like.

On May 1st we see the spread:

On May 8th, notice how it tightened:

The key is to stop this before it begins. With Hive, there is a haircut rule meaning that when the percentage of HBD (by marketcap) reaches a certain percentage of HIVE, then the blockchain stops producing the HBD. Thus, there is an initial limitation to the amount of HBD that can be out there based upon the total marketcap of HIVE.

At present this is 10% but it is being increased to 30% in the next hard fork.

Thus, getting to this point is impossible with continued creation of HBD. Long before the ratio achieved the level of LUNA-UST, the blockchain would stop generating HBD.

It is important to learn from the plight of others. Fortunately for Hive, there are security measures in place to protect the chain. Could there be more? Certainly. In fact, we need to keep analyzing ways to make things more secure.

One of the defenses is the lack of liquidity. This will hopefully change over time. The key with this is to, as the supply is expanding, develop a host of uses cases. The reality is that LUNA's main use case was to generate UST. There was little else.

With HIVE and HBD, we have the opportunity to build value (different from price) which makes it necessary to hold the token. This is the true defense of coins like these.

In closing, we are in a strong position. While many are upset about the lack of rapid growth in token value, situations like these teach us how valuable security is. Sometimes the best approach is the more methodical one.

There will come a time, if building continues, where Hive will be tested. This means we best prepare for it. By having a defensive foundation in place, we have the opportunity to add more.

It is obviously something the Luna Foundation completely overlooked (or didn't care about).

Either way, it would be very difficult to do something similar to HBD as was done to UST. A big part of that is they are not on the same scale with each other. If HBD does achieve that status, we will need a lot more defenses in place.

Sometimes having time is the best defense of all.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta