As stated on a number of occasions, the relationship between $HIVE and the Hive Backed Dollar (HBD) is one of the most interesting aspects of the ecosystem. Here we have a situation where we can see buy demand essentially created for $HIVE through the desire to get HBD.

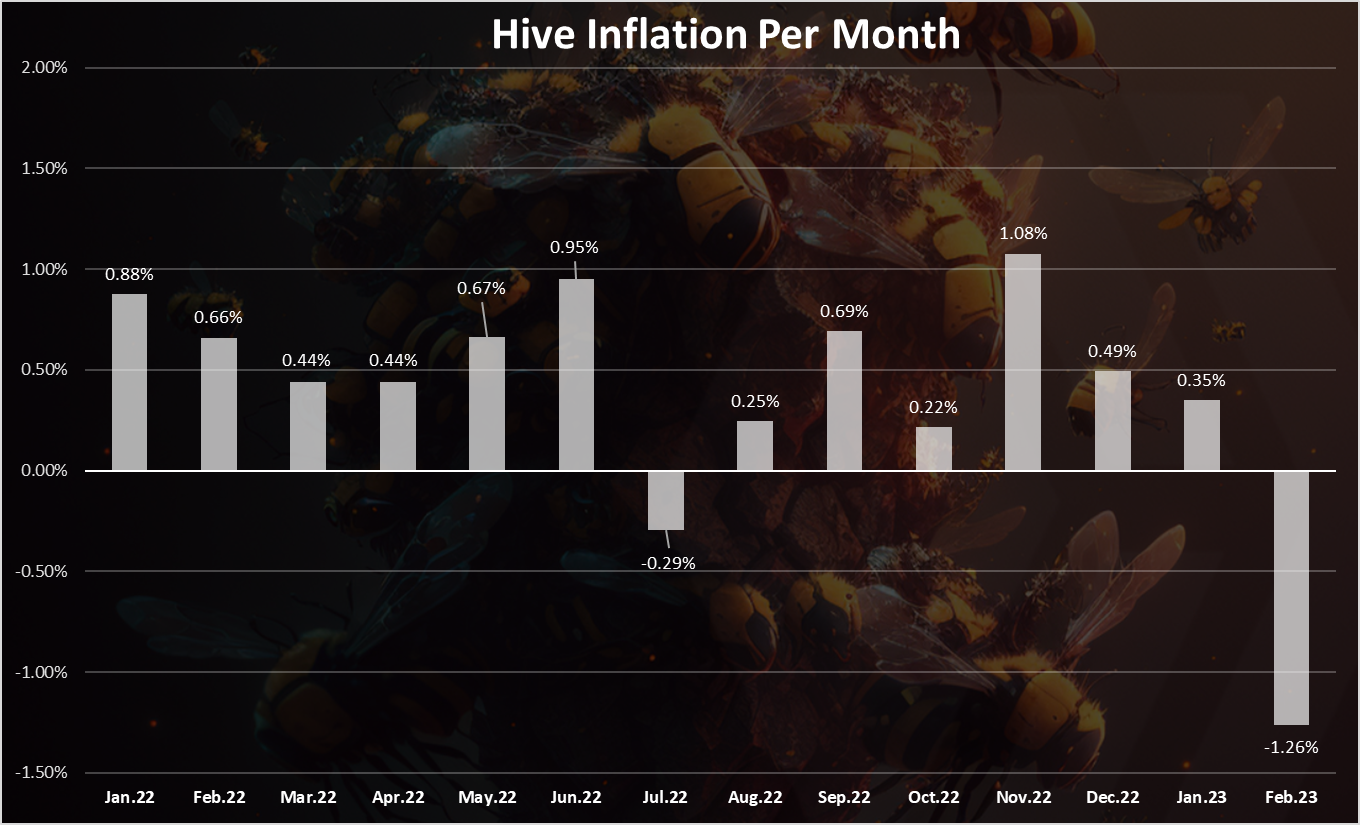

We got the most recent monthly report telling us how the numbers looked for the month of February. To the surprise of most, $HIVE was actually deflationary for the month. This means there were less coins available at the end of the month as compared to the beginning.

As we can see from this chart, the deflation rate for the month was 1.26%.

Most would cheer this on although, as we will see in a bit, this might not be a good thing. Nevertheless, it does highlight the impact HBD can have.

HBD Liquidity Crisis

We stated in the past that HBD has a liquidity crisis. There simply is not enough of it out there. This is only going to get worse as demand for the coin grows with increased utility.

At this moment, we are aware there is a large appetite for this from one account. That is over 1 million HBD in savings, with the intention of going to 4 million. Here we see how the demand can really skew things.

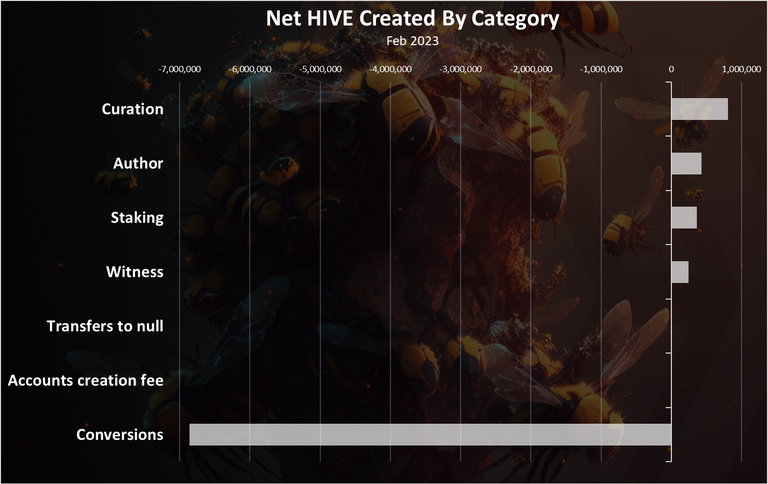

Since there was little HBD on the market, the likely approach was to purchase $HIVE and convert it. This, along with other ones, caused the change in inflation rate.

We are going to need a lot more HBD. There are a number of use cases being constructed and this is going to put further pressure on the amount available.

Therefore, we can expect months like this in the future.

As Expected

Over the last 18 months, we discussed the idea of currency a great deal. The reason for this is most misunderstand how things truly operate. What we are seeing here is not unexpected.

A basic ideas here is that fixed income investors are much different than speculators. The former is going to invest when they see things are right, no matter what the market. Yield and putting money to work is more important than timing.

It is important to take notice that real world operations went in the exact opposite direction as many theorize. Aren't we told that people will convert HBD when the price of $HIVE is low and then convert it back when price moons, creating a point of vulnerability? To put it another way, the threat is that a huge amount of HBD is created when the market runs and then, when the price drops, tons of $HIVE will be created.

We have to prepare for this possibility and work to prevent all potential points of attack to the ecosystem.

Yet here the exact opposite happened. The conversion took place at a level where many of us feel $HIVE is cheap. What happens when $20 million wants to get into savings and take advantage of the outstanding return provided by Hive's stablecoin?

Where will 20 million HBD come from?

This is why we can expect months in the future to reflect this.

Is Less $HIVE Good?

Many feel that Hive being deflationary is a good thing. However, here is where things can get cloudy.

The common belief is less token or coins, price goes up. Thus, the reverse also has to be true.

Unfortunately, as we are seeing, this is not exactly playing out this way. What is really happening is the multi-faceted, convoluted practices of currency.

With $HIVE, we are dealing with an access token. That means that less available equates to less Resources Credits available. In turn, not only can less activity occur on-chain, expansion is stunted. The reason for this is less accounts can be claimed, in theory, due to the reduced supply. Obviously, we are not at 100% staked but the point is clear.

Another factor is the market capitalization is reduced. With the two coins, the value is placed upon each. We know markets are not exact. Nevertheless, if we create $7 million on HBD, that has to come from somewhere. Naturally, it would appear that has to be removed from the market capitalization of $HIVE.

Markets are never perfect which is why we say in theory. Nevertheless, we could see an increase in the ratio as it applies to the haircut. This is less of a factor since $HIVE had a freely floating exchange rate. Under this scenario, the USD price can fluctuate, helping to offset this.

Here is what the total numbers look like:

In terms of absolute numbers the HIVE supply in February has decreased from 396.4M to 391.3M, removing -5.1M HIVE from circulation. For comparison the projected monthly inflation is around 2M HIVE.

The haircut ratio is dependent upon USD pricing. However, Resource Credits operate without any regard to the market activity. This is solely based upon the activity and interaction with the blockchain.

Explosion In Price

All of this is proving what we covered in the past couple years.

There are a number of demands on $HIVE that will cause the price to appreciate over time. This can occur without the need for hype, pumps, or even a bull market. Instead, simple demand created by utility can push the price to insane levels.

One interesting stat would be to see the percentage of Hive Power compared to the total $HIVE in circulation. My thought is that, over time, this is going to have to increase. After all, the only way to get more Resource Credits is for someone to stake $HIVE.

As we saw in February, the need for more HBD drove the conversion to rarely seen levels. What happens when we have a much greater need for Resource Credits?

The answer is clear since the most freely moving variable is the USD price.

It really comes down to simple math.

Pictures and quote from article linked

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta