It is no secret that bankers always played by a different set of rules than everyone else. This went on for decades, creating a situation whereby they were able to massively enrich themselves. Over time, this did generate enormous wealth, albeit poorly distributed.

One of the fundamental premises of cryptocurrency is that a digital wallet, for most people, acts like a bank. The majority of people utilize a bank to send, receive, and restore money. This is precisely what a digital wallet can do without the need for the bank (or bankers). Here we can see a point of vulnerability as more money is removed from the banking system and held within cryptocurrency.

Many feel what is taking place in cryptocurrency is unnatural. The reason for this is because they are being exposed to something they never saw before. That said, this is not novel. In fact, we have roughly 70 years of ledger technology and "balance sheet" banking. The ability to create money out of thin air is nothing new. Yet, it operates in an area few understand.

Nevertheless, it is time for us to adopt a new mindset. If we do that, we can begin to understand the true power of cryptocurrency.

Source

Abundance

Do you like the idea of making money to make money?

This is something the international banking conglomerate came to understand a long time ago. Why play in a finite world when you can expand that greatly? Whereas most of society was operating on a limited scale, engaging in a battle of scarcity, the bankers were immersed in abundance. It is little wonder they spent decades hiding this from everyone.

Cryptocurrency is opening this up to the entire world. Anyone is now free to participate in what is taking place. We see massive expansion, something that we can expect to continue. Again, what is taking place is not novel.

Some find it odd that there are more than 9,000 cryptocurrencies. Here we see people saying there is no way they can be valuable. While many are going to die simply from lack of use, this does not mean they do not have value.

For decades the banking system kept devising different forms of money. They would create convertible notes, LIBOR future contracts, and anything else they could lend, collateralize, or use for cross border payments. A $10 million line of credit from Goldman Sachs became an international asset to borrow against for much greater returns.

The point here is that the bankers knew they were not limited. For this reason, they were not seeking a return of 5% or 7%. They operated at a much higher level. This is something we are seeing in cryptocurrency yet most are astonished. Keep in mind, you are scarcity, they are abundance.

Cryptocurrency is bringing abundance to everyone. It does not take long to amass a nice sum when getting 30%, 40%, or greater. Bankers understand the power of compounding, another concept lost on most people. Keep these rates of return up over a decade and you can see trillion created. Push that out a few decades and the numbers grow into quadrillions.

Source

Magical Internet Money

This is a nice phrase that people attribute to cryptocurrency. The idea of creating money in such a manner is so incomprehensible to people that they call it "Magical Internet Money".

It is best to understand there is nothing magical about it. Money is a social construct, developed by humans. It is our invention. Some want to believe that it is somehow natural, even ordained by God (Robert Kiyosaki). It is not. Money is what we created and it evolved over time. In fact, as cryptocurrency is proving, it is entering another evolutionary phase.

In this sense, we can view money, itself, as a technology. Over time, as more is developed, we see things expand and improve. This is the history of money. We are not dealing with the same system of 1,000 years ago. Or 250 years ago? Or even a decade ago?

Through the evolution, we see improvements being made that allow for the further advancement of society. Money is allowing for collaboration between larger numbers of people, generating economic expansion. The only reason Elon Musk can blow up rockets to the tune of tens of millions of dollars each is because of money. The same is true for cancer research, the development of 3-D printing technology, or the production of new agriculture equipment.

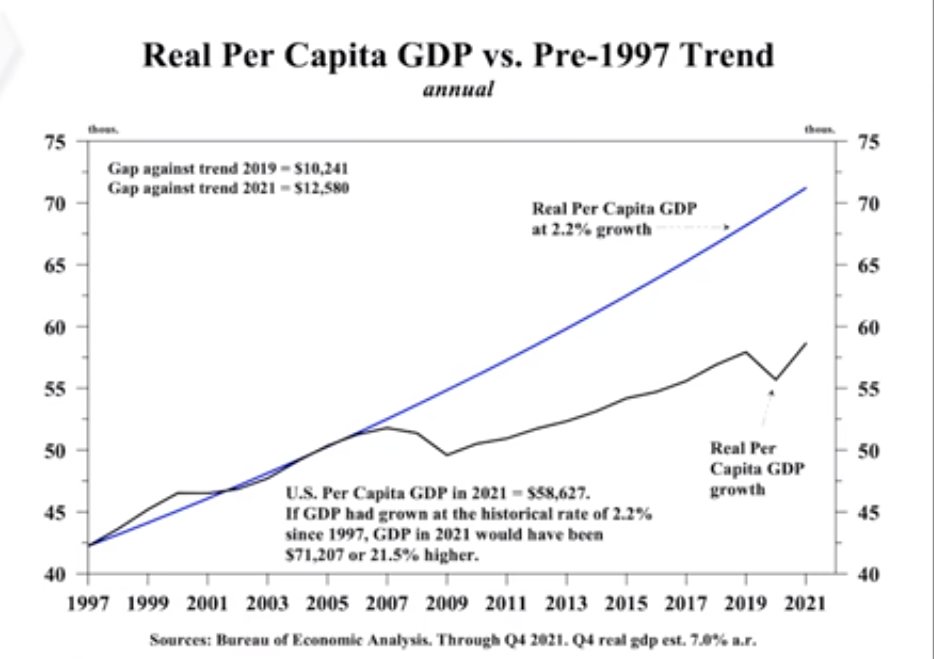

Which brings us back to the abundance topic. When we understand the collaborative element, we have the potential to generate massive economic output. This is something that is sorely lacking over the last couple decades. Since the Great Financial Crisis, the United States (along with the rest of the world) fell below the longer term trendline.

As we can see, if we just kept the growth rate (2.2%) that was in place going into to GFC, we would have a GDP 21% higher or almost $5 trillion higher.

Cryptocurrency can reverse this trend. We now have the ability to generate the monetary resources required to fund what we need. Collaboration always leads to expansion. Contraction, or slowing, occurs when there is not enough collaboration taking place. This makes sense when banks get stingy with their lending, which they do when we encounter rough economic waters.

Here is where an alternate system truly be the stimulant needed.

Source

We Are The Bankers

Getting a rate of return means having more capital to invest. This is something that is primarily done by the bankers. Wall Street also plays a part in this. However, this is something that can be taken over by those in cryptocurrency.

In the post Access To Real Estate Through Tokenization , we laid out the following scenario:

Going back to real estate, let us start with the construction. At present, developers go to banks (or other money agents) and get loans. This enables them to build on the property whereby the units are sold to individuals, who also go to a money agent to get a loan.

If this process is tokenized, $50 million can be raised through individuals. Getting $50 from 1 million people is still $50 million. This provides the development costs with the individuals "becoming the bank".

When the process switches from development to sales, the units can also be funded through the tokenization process. Through the use of a smart contract, another set of token holders can fund the individual unit, say for $250,000. This helps to provide a return to the original token holders while the second group acts as the mortgage holder. They get paid each month (or whatever interval) just like a bank.

It is a very simple premise of how individuals, through Decentralized Finance (DeFi) can becomes bankers. We are able to take our assets (cryptocurrency) and loan them for economic expansion. Here we are dealing with the development of real estate. That said, this could easily extend into rocket construction, longevity research, or renewable energy generation. Whatever we want to create, we can generate the resources to fund it.

How many great ideas died before they even had a chance to evolve simply because they were not funded? We know that start ups cannot turn to the banking system. Thus, we are left with the Venture Capitalists, who perform a much needed service but also come with their own drawbacks. This means a large portion of the market is left not serviced from a monetary perspective.

We can change this. No matter what the cause, the "new bankers" can develop the resources needed. Cryptocurrency is going to be tied to DAOs and other business structures that generate capital on a scale never seen before. It can also be targeted since those generating the capital are also likely to be interested/involved in that area. This is where we see the evolution of "communities" taking place. They will become their own economies built around a centralized theme.

Beyond Capital Generation

We are in the early stages. At present, it seems we are in the capital generation phase. While this never goes away, it is the primary focus right now.

Quite simply, there is not enough cryptocurrency available to make a significant difference. With a total market cap of $2 trillion, we are playing with peanuts relatively speaking. The number have to grow by many orders of magnitude to have enough resources available to fund what is needed. Of course, we also are watching the infrastructure being built, another hindrance at the moment.

Here is where the power of compounding enters the picture. As we see the total value rise, it will grow exponentially. Each day, new tokens are created for existing projects. This is the first leg of resource expansion. The second is the development of new projects, with more being tokenized. Finally, we have the overall upward trend of the value in USD, the common unit of account the global economy uses.

However, with all this expansion comes the next phase. At some point we will need to understand that Decentralized Finance (DeFi) means we are all bankers. It is up to us to fund the different projects that come up.

The capital we are generating is nice from a personal wealth perspective yet the goal of cryptocurrency should be to radically alter humanity. While enriching individuals is important, we also need to realize that advancement is what we are really after. This requires funding.

And that is going to come from the person who is looking back at you in the mirror each day.

Hopefully we can see how it all ties in together and how this path is much bigger than most people believe.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta